What are the statutory requirements?

Elements of financial education are mandatory for some age groups in maintained secondary schools via the National Curriculum for England.

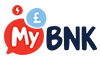

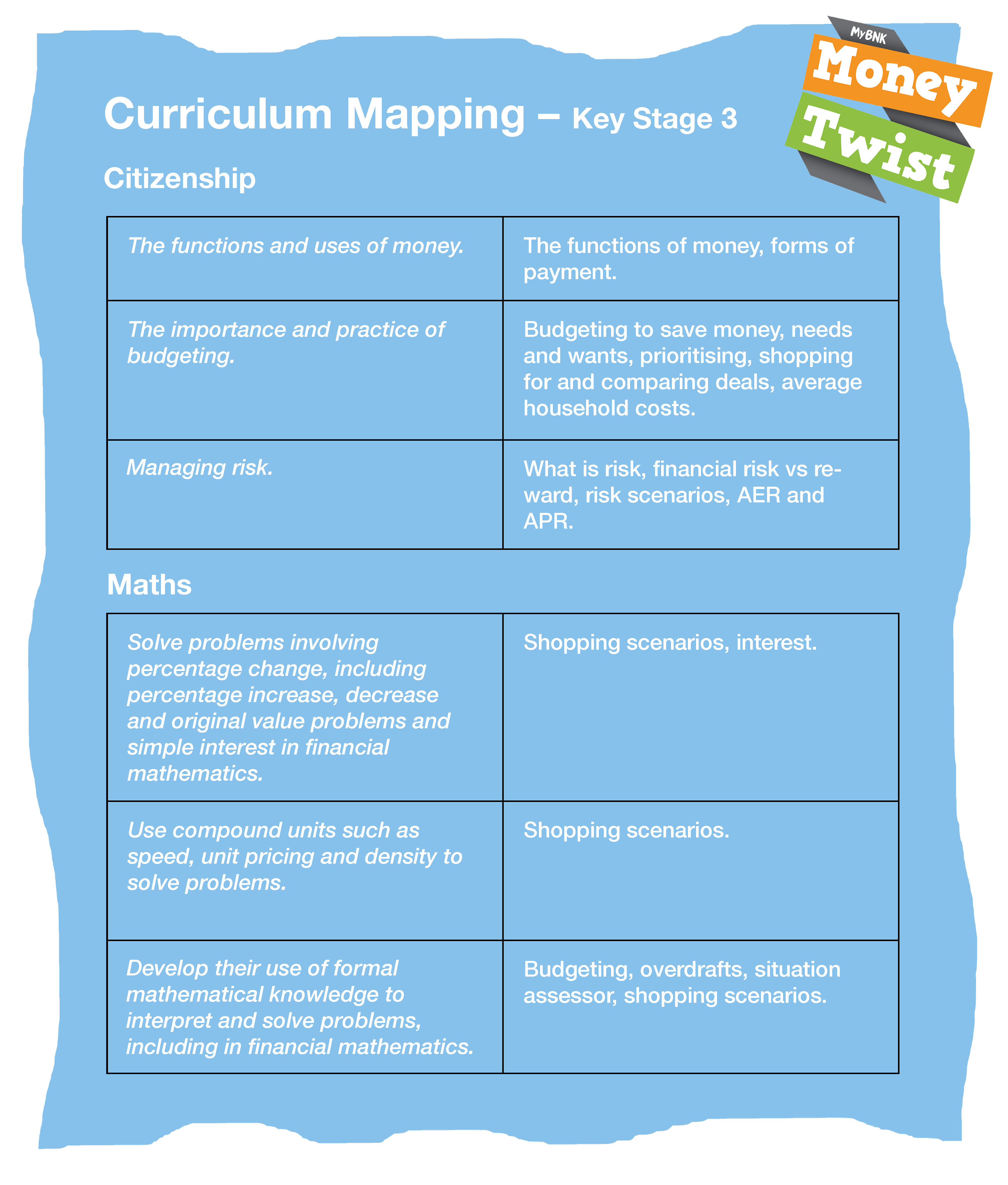

In Citizenship Key Stage 3 & 4, the curriculum covers day-to-day money management and planning for future needs. This includes budgeting, managing risk, public money, insurance, savings and pensions, income and expenditure, credit and debt and financial products.

For Maths Key Stage 3 & 4, the curriculum covers problem solving in financial mathematics. This includes percentage changes, simple and compound interest, loan repayments. The original draft curriculum published in February 2013 originally also included developing mathematical fluency by applying arithmetical and graphical methods to the world of finance, however this was subsequently removed. MyBnk have always covered this aspect of the Maths curriculum, and will continue to do so.

By designing programmes in-house with financial experts, qualified teachers and young people, and delivering sessions direct, we have a unique insight into how material is being received by students and teachers. Many of our programmes are free or funded and can be delivered either directly in-person, virtually or as online courses.

How our programmes map

Citizenship – All of the curriculum guidelines are met via our Money Twist Key Stage 3 & Key Stage 4 programmes. We believe lessons should not just reach these requirements, but exceed them.

Maths – The National Curriculum stresses the importance of mathematics as ‘necessary for financial literacy and most forms of employment’. Money Twist seeks to get young people applying functional mathematical knowledge and skills in a practical manner, allowing them to realise the vital role of maths in everyday life, both now and in the future.

Financial Education Planning Framework

MyBnk has collaborated with members of the Youth Financial Capability Group (YFCG) to create a comprehensive Financial Education Planning Framework for UK teachers. Download your chart for 3-11 and 11-19 year olds.

The YFCG consists of MyBnk, The London School of Business & Finance, Young Money, The Money Charity, The National Skills Academy and Money Advice Service.