Format

3 x 100 min sessions – Can be delivered over 2-3 separate sessions

Target Group

11-14 year olds

Group Size

12-30 young people

Content

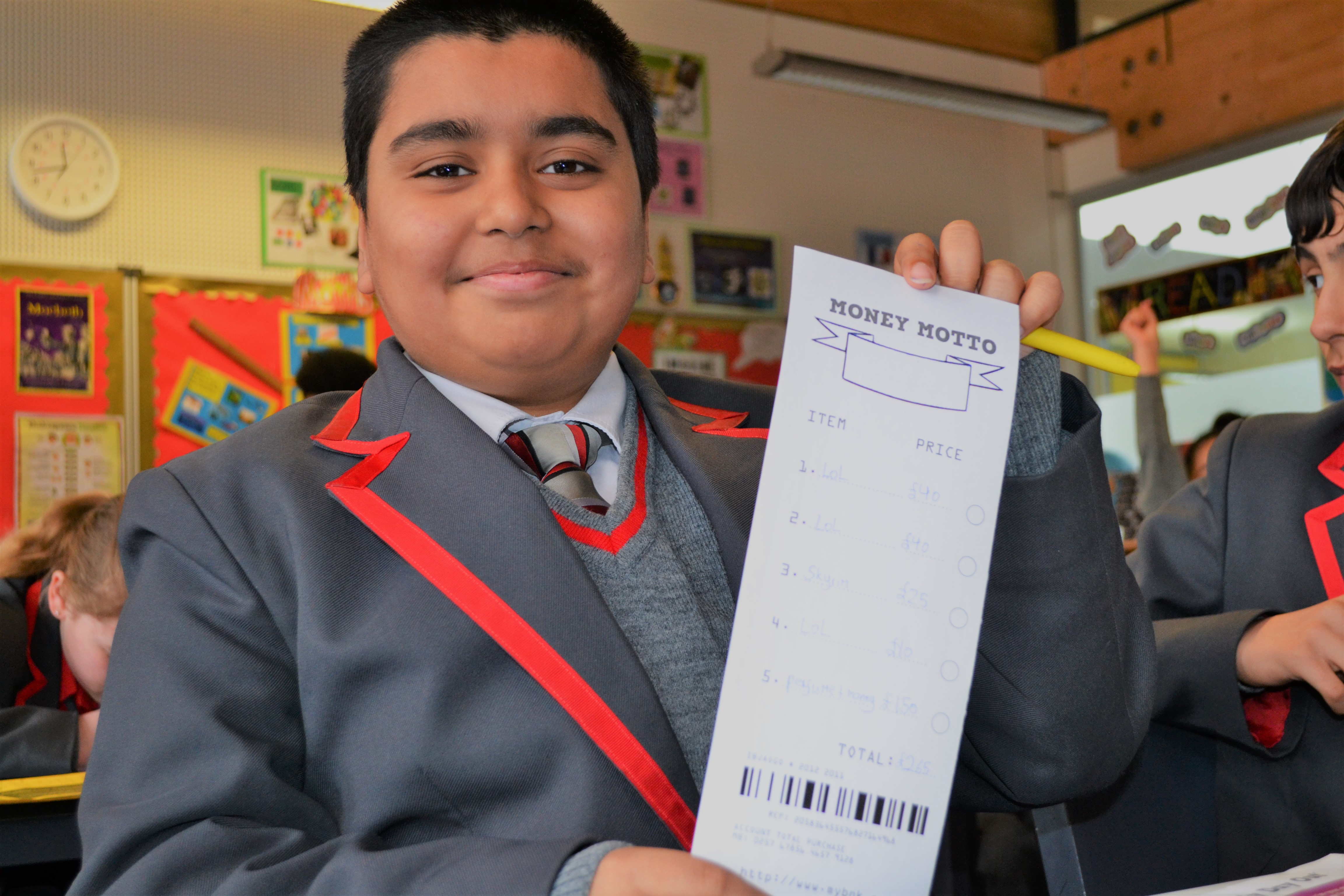

A highly interactive financial education programme building young people’s knowledge around basic finance and helping them engage with money.

Money Twist involves writing, presenting, drawing, maths and problem-solving.

Sessions cover:

- Session 1: The functions of money, understanding their relationship with money and the impact that advertising, peer and media pressure, and shopping deals can have. Alongside comparing costs and benefits of a range of goods and services.

- Session 2: Exploring the cost of living, wages and income to learn budgeting skills, differentiating needs from wants and making financial decisions based on their circumstances.

- Session 3: Making good money decisions based on current and savings accounts, interest, flow of money, understanding bank statements, overdrafts and the future of money.

See how this programme maps into the National Curriculum and references the UK’s Financial Education Planning Framework for teachers. An online version is also available.

Money Twist engages pupils to discuss, present, problem-solve and apply maths. We use real life case studies, ‘escape room’ style games, and videos, enabling them to understand habits, motivations and how to manage their relationship with money.

Activities cater for a variety of learning styles, with extensions and ability variations. The content maps into the financial literacy parts of the Citizenship, Maths and PSHE curriculum. It is ideal for financial capability focus days, enterprise weeks, or can be built into a scheme of work over a number of weeks.

Multiple sessions can be run simultaneously to allow several classes to take part at once.

Money Twist has been evaluated and proven by The Money Advice Service’s Evidence Hub. This programme also won Children & Young People Now’s Financial Capability Award 2010!

MyBnk Cancellation Policy: Cancellations and changes made to scheduled deliveries incur costs to MyBnk. Any changes made less than two weeks in advance will result in a £100 or, if less than three working days, £250 charge per MyBnk trainer. Full Terms & Conditions here.

Impact After This Programme

73

Teachers who thought MyBnk training was more effective than the training delivered by school staff

31

Pupils who have not made a financial plan that now would

45

Pupil’s shift towards moderating extreme spending and savings habits