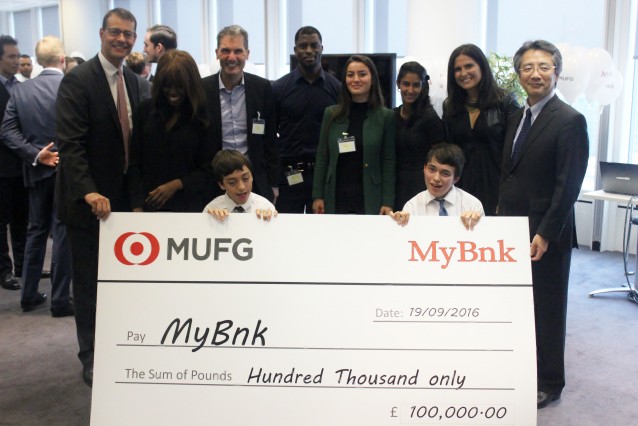

The UK’s highest-rated money skills programme for young people is coming to schools and youth organisations in some of London’s poorest boroughs, thanks to a £100,000 grant from Mitsubishi UFJ Financial Group (MUFG).

Broadcaster, campaigner and MyBnk Patron June Sarpong helped launch the charity partnership with Masahiro Kuwahara, MUFG’s EMEA CEO and Guy Rigden, MyBnk CEO, and members of our Youth Advisory Panel at MUFG’s London Headquarters.

Over the next two years MyBnk will arm over 1,200 students with real-life money and business skills through hands-on financial education and enterprise workshops within Tower Hamlets and Islington.

11-18 year olds will learn how to budget, bank and borrow, dodge debt, understand taxes, tuition fees and employment rights and prepare for independent living via our Money Twist and Money Works workshops. They will also become entrepreneurs by creating their own products and learning how to cost, market and sell in our Mind Your Own Business employability programme.

Teachers and youth workers are invited to register their interest with MyBnk now for access to funded workshops.

17-24 year olds in the UK are currently, on average, £12,000 in debt and last year just 26% of teachers taught money lessons.

The government’s Money Advice Service has given MyBnk’s project for young people the UK’s highest effectiveness rating. After the sessions, students see a 40% increase in understanding of credit, interest rates and inflation, an 18% rise in positive attitudes towards money and a 25% jump in skills.

June Sarpong, MyBnk Patron said:

“As a country we need to think hard about how we source and nurture talent. I’ve worked with a lot of causes but the work MyBnk does is phenomenal, effective and their team know their stuff. They can communicate with young people on a dry but vital subject like money and bring it to life. You are all in for an amazing experience!”

Full house at MUFG HQ!

Andrew Jameson, MUFG’s Executive Officer, Head of Investment Banking, and Chair of CSR Committee said:

“From my experience working with young people in our community, and having seen some of the training MyBnk will deliver, I am confident that by the end of our two year’s working together we will have a truly positive and transformative impact on the young people we reach out to though this partnership.

Gaining the skills and confidence to manage finances early in life is critically important. We are delighted to support MyBnk to expand their services in the local community. Learning how to use credit effectively, tackle debt or make wise spending decisions will help the students to live more prosperous lives.”

Lily Lapenna, Founder & Co-Chair of Trustees

Guy Rigden, MyBnk CEO, said:

“We are thrilled to be bringing money to life for young people in these areas. Managing money well opens up new opportunities and helps make informed decisions. When it comes to debt, prevention is always cheaper than the cure and right now, as individuals, we owe £1.45 trillion! Schools, teachers, please get in touch.”

“MyBnk is thrilled to help launch what I know will be a lasting and hugely impactful initiative that will arm over 1,000 young people with the skills to manage money in some of London’s poorest areas. Together our work will tackle poverty at a grassroots level and have community action at its heart.

Lily Lapenna, MyBnk Founder & Co-Chair said:

“Our trainers will be there for some of young people’s biggest ‘firsts’; from opening a bank account and leaving home, to accessing credit and starting university. Many of them will live to 100 and be competing with robots! With MUFG’s support, young people can prepare for their future and develop an entrepreneurial mindset, giving them the edge in an increasingly competitive environment.”

For more information, photos or to visit a session in action, please contact declan@mybnk.org.