Our expert-led programmes aim to give young adults in vulnerable circumstances ‘survival’ money skills and knowledge that they can implement immediately in their transition into independent living.

These financial education workshops focus on debt prioritisation, money management and digital finance skills. Delivered through councils, charities and non-mainstream education institutions, we help those often not in employment, education or training or leaving care, detoxify their relationship with money.

Many of our programmes are free or fully funded and can be delivered either directly in-person, virtually via secure video link or as online courses.

Every £1 spent on MyBnk’s young adult programmes creates £5.57 in social value and the impact increases as time goes on. Case studies available here.

See how we map our financial education programmes to the requirements of the national curriculum and outcome frameworks in Northern Ireland.

Young Adults

Money Works

Aimed at young adults not in mainstream education. This directly delivered and accredited survival money management programme focuses on independent living, digital finance skills and debt prioritisation. Independently evaluated by the Money Advice Service’s ‘What Works Fund’.

Our expert-led school age programmes aim to build financial capability at key transitional moments, addressing mindsets, attitudes and behaviours to help young people form an understanding of the wider world of money.

These financial education workshops help form positive habits like saving and delayed gratification, connect the dots between public and personal finance and arm young people with practical money skills. This teaches them how to navigate the system and make informed decisions. Topics range from budgeting, banking and borrowing to student finance, tax and pensions.

Many of our programmes are free or fully funded and are delivered directly in-person or as online courses.

See our Impact section and case studies for evidence on the powerful effect of our school programmes and how we map to the National Curriculum.

Primary

Money Twist

This free directly delivered programme combines full year assemblies, workshops and teacher and family resources to build positive habits early, such as saving and budgeting and improving financial confidence. Independently Assessed by the Money Advice Service’s ‘What Works’ Fund.

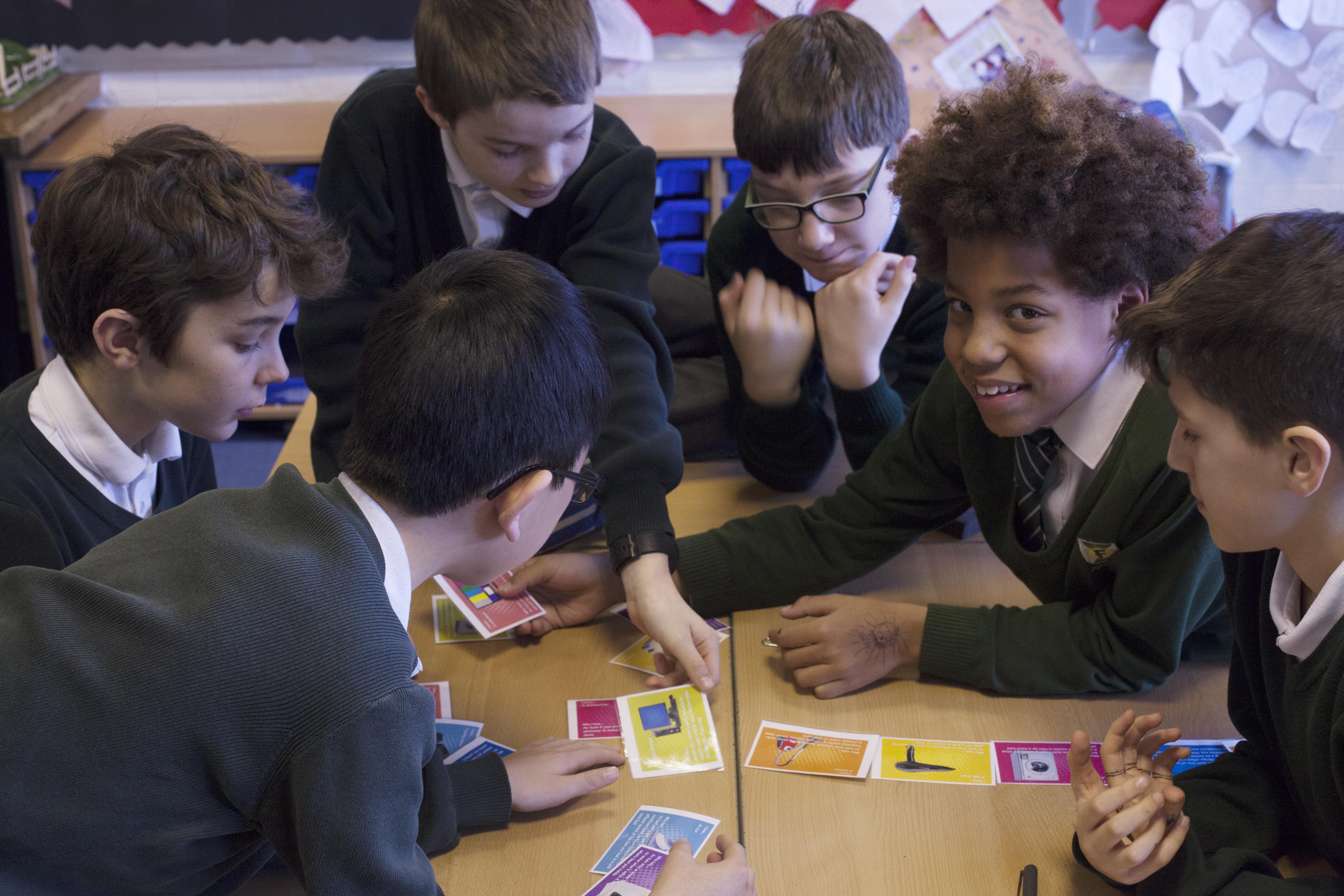

Secondary

Money Twist KS3

Aimed at 11-14 year olds in secondary schools. This directly delivered programme covers practical and relevant everyday financial matters including budgeting, needs vs wants, careers, tax, banking, interest, and savings. Independently evaluated by the Money Advice Service’s ‘What Works Fund’.