64% drop in eviction rates for ‘at risk’ young people – Practically preventing youth homelessness

The latest of our independent reports into the effectiveness of MyBnk’s financial education projects has shown dramatic reductions in the number of vulnerable young people being evicted from UK social housing.

The latest of our independent reports into the effectiveness of MyBnk’s financial education projects has shown dramatic reductions in the number of vulnerable young people being evicted from UK social housing.

Nearly a thousand 16-25 year olds, in care or sheltered accommodation, took part in a two year impact study of ‘The Money House‘ project in London.

Findings from independent evaluators, ERS, found participants were now three times less likely to have unsustainable arrears and there was a 64% drop in evictions for those ‘at risk’ of losing their home. The report was part funded by the Money Advice Service.

In the midst of a housing and homelessness crisis, research tells us one in three care leavers currently lose their first home and 83% of evictions are caused by rent arrears . It costs on average £7,056 to evict a tenant. Evaluators found over £300,000 of direct savings in this project alone. 10,000 young people leave care annually meaning cash strapped councils could save millions of pounds.

Only 1% of The Money House graduates have ever been evicted.

Capability and exclusion

After MyBnk’s expert-led intervention there was a:

After MyBnk’s expert-led intervention there was a:

- 45% reduction in those incurring bank charges and missing bills.

- 22% increase in those borrowing safely, and therefore avoiding loan sharks.

- 27% increase in confidence managing money, which exceeds the national average.

There were also large reductions in instances of financial and digital exclusion for those who were unbanked and had never saved or budgeted. 54% were now saving, 35% budgeting, 75% now had a current account and 44% use online banking.

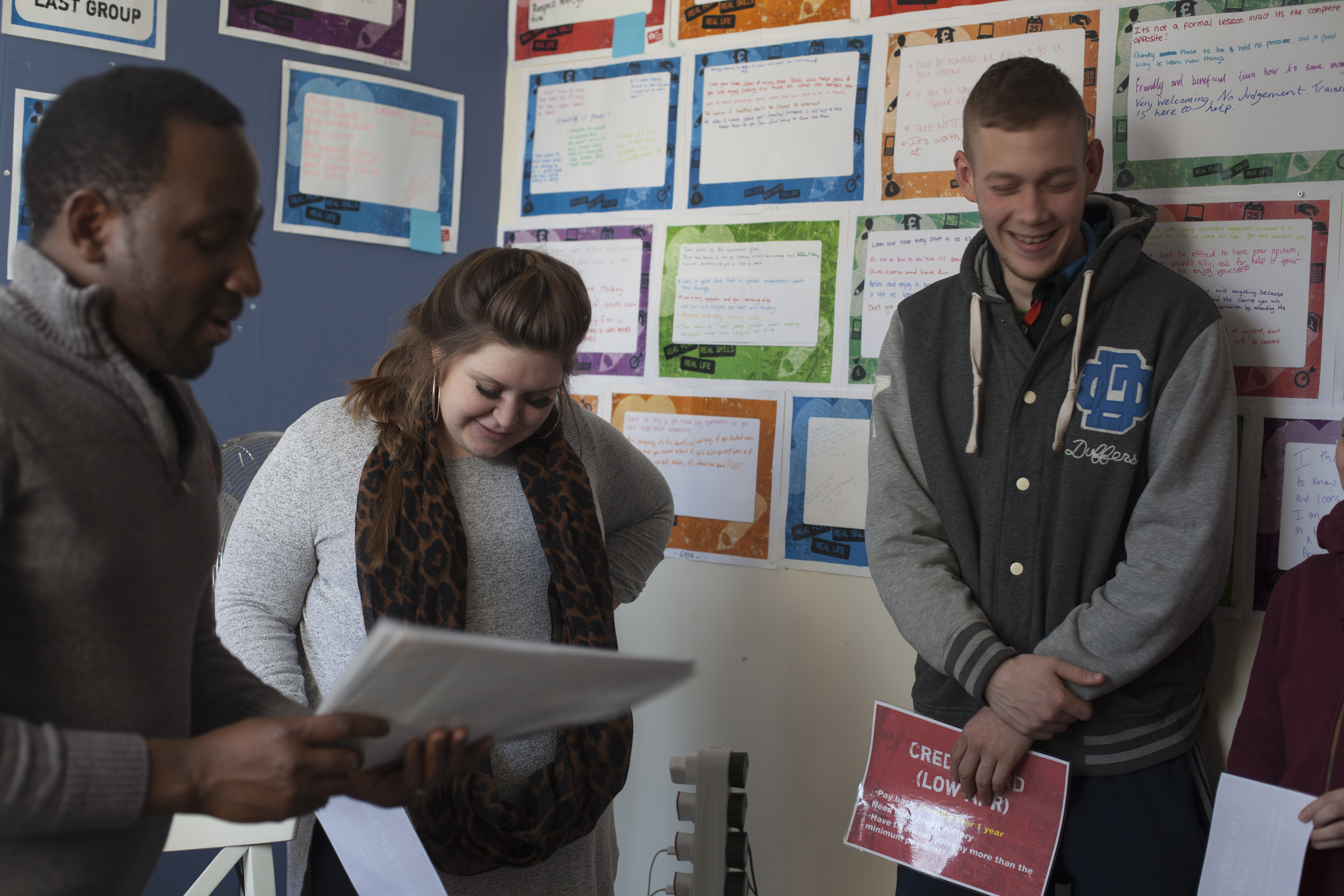

The homelessness prevention scheme is based in real flats in the Royal Borough of Greenwich, and London Borough of Newham. Over five days young people gain the skills, knowledge and confidence to live independently – learning how to manage their money, prioritise debts, avoid scams and navigate the banking and new benefits system. Trainers use ‘escape room’ games, role play and activities mined from youth culture with diary room recordings to help bring money to life.

Four councils including Lewisham and Tower Hamlets, along with various sheltered housing providers such as Centrepoint, the YMCA and De Paul, have made it mandatory for any young person applying for social housing. Referrals are free and open.

Every £1 spent on the programme generated £3.36 in social value, according to the respected Housing Association Charitable Trust social value model. Now in its sixth year, funding has just been extended to 2021 by the Berkeley Foundation and JPMorgan Chase Foundation.

An investment in young people

The new Children and Social Work Act places a legal duty on local authorities to protect young care leavers’ economic wellbeing and ensure access to financial information. In 2016 The Children’s Society found that almost half of councils in England fail to offer these services. Local authorities ‘intentional homelessness’ policies means many young people lose their entitlement to social housing. 30% of homeless people have spent time in the care system.

The new Children and Social Work Act places a legal duty on local authorities to protect young care leavers’ economic wellbeing and ensure access to financial information. In 2016 The Children’s Society found that almost half of councils in England fail to offer these services. Local authorities ‘intentional homelessness’ policies means many young people lose their entitlement to social housing. 30% of homeless people have spent time in the care system.

ERS’ findings strengthen the case for providing trained expert money guidance for vulnerable young people, which is backed by reports from the All Party Parliamentary Groups on Financial Education for Young People, and Ending Homelessness, and the Mayor of London.

The National Audit Office found problem debt is costing UK taxpayers £248m and wider society £900m per year. 18-24 year olds have average unsecured debts of £1,460 and are the UK’s fastest growing group of debtors, according to the Financial Conduct Authority. They are also the most susceptible in society to fraud and scams, says the Policy Network.

Quotes

“Often in this job I have to tell organisations their interventions may not be getting the results they set out to achieve. That is not the case with The Money House. It is very gratifying to see such positive outcomes and the values generated by this project are testimony to the quality of the intervention which is clearly having a major impact on the lives of the young people concerned.” Keith Burge, Managing Director, ERS.

“Working with vulnerable young people at these transitional periods is crucial. That’s when they are at the highest risk of making the poor financial decisions that can have lifelong consequences. Social and key workers are under immense time and resource pressures to meet the need. These results, show investing in young people and the use of expert-led direct delivery of these specialist areas pays back for everyone.” Guy Rigden, CEO, MyBnk.

“There is a real lack of cost benefit analysis in financial education, including with young adults transitioning into independent living – but this report provides a fantastic contribution to the growing evidence base. The Money House is an excellent example of providing vulnerable young people, such as those leaving care, with the skills and knowledge they need to manage their money and stay out of problem debt. By providing them with the awareness and confidence to seek advice, the programme has made strides in helping them with their transition to independent living. The findings from this programme will undoubtedly inform the practice and delivery of young people’s financial education.” Sarah Porretta, UK Financial Capability Director at Money Advice Service.

“We are delighted with the results of this report, which demonstrate the significant impact The Money House is having on the lives of vulnerable young Londoners. This is a shining example of how the public, private and voluntary sectors can work together to help young people gain the skills and confidence to sustain their first homes, and I look forward to seeing the programme grow and develop over the coming years.” Sally Dickinson, Head of Berkeley Foundation.

Key documents:

- Case Studies: Chanel, 19 – Hawa, 20 – Tameera, 20.