Young people can defer gratification and start saving if exposed to expert-led financial education at primary school age, according to a ground-breaking study of MyBnk’s workshops in England.

Young people can defer gratification and start saving if exposed to expert-led financial education at primary school age, according to a ground-breaking study of MyBnk’s workshops in England.

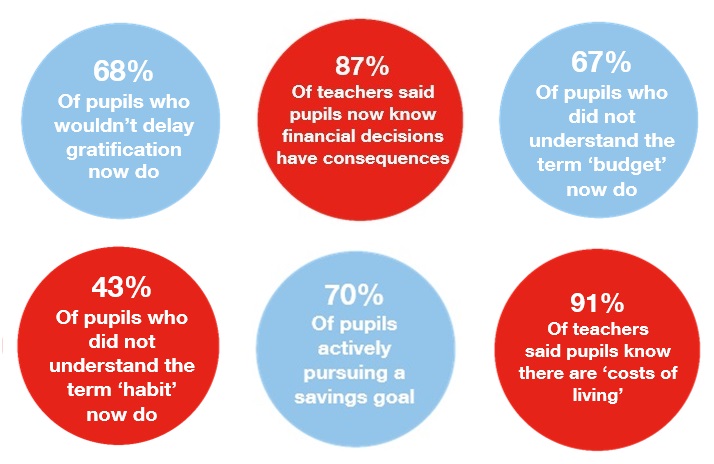

Substance, an independent research group, found 7-11 year olds are also able to understand new knowledge such as banking, gain skills like budgeting, forge habits including resisting temptation and conceptualise the future by recognising the consequences of financial decisions.

The academic yearlong study analysed data from 1,444 pupils and 187 teachers at 86 schools participating in our Money Twist programmes as part of the Money Advice Service’s (MAS) ‘What Works’ project testing the effectiveness of interventions across the UK.

Source: MyBnk, Substance, Ipsos Mori. 2017/18.

Source: MyBnk, Substance, Ipsos Mori. 2017/18.

Dramatic improvements in financial capability were detected with pupils reporting low knowledge, confidence and regular saving patterns. Sessions including videos, manga comics, games and role play covered the value of money, consumer choices, mind-sets and prioritisation. Four hours of face-to-face expert led sessions were supported with six hours of teacher resources and four hours of family activities.

Andrew Bailey, Chief Executive of the Financial Conduct Authority has warned of a “pronounced” build-up of debt among young people. The UK household saving ratio also hit a record low of 1.7% of GDP last year, according to the Office for National Statistics.

Despite studies proving behavioural attitudes to money are partially formed by the age of seven, there is no compulsory financial education in English primary schools. Just a third of UK parents speak to their children about money and only 4 in 10 children say they have learned about money management at school, despite 9 in 10 young people saying it was useful. (MAS, 2016).

MyBnk’s primary school project is supported by Kickstart Money, an alliance of 20 of the UK’s largest investment firms.

Key documents:

For more on Kickstart Money visit www.kickstartmoney.co.uk