The London Assembly Economy Committee have recommended creating a young person’s banking charter, with the aim of ensuring all 16-18 year olds have a bank account.

‘Short changed: the financial health of Londoners’, makes a number of recommendations for the Mayor to improve financial inclusion and capability, including:

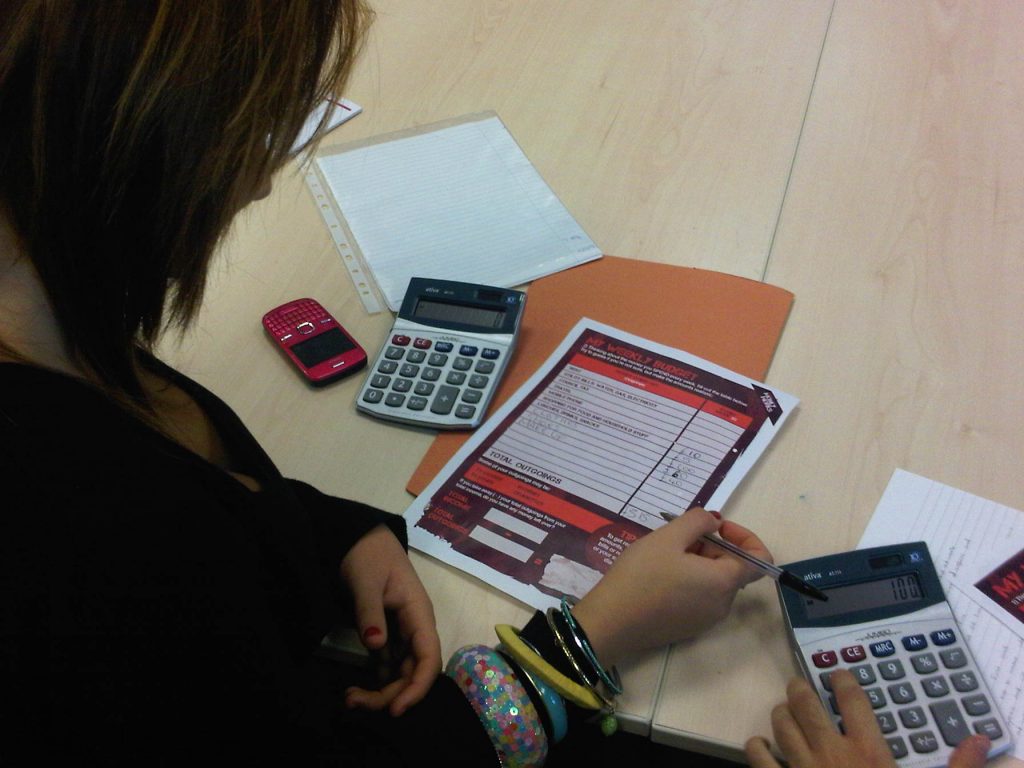

- Work with schools, charities and the financial services industry to deliver high quality financial education for young people.

- Hold an awareness week and conduct a survey to understand Londoners finances.

These constructive recommendations are accompanied by worrying findings that lay bare the pressing need for young people to be financially literate as well as have access to services.

- Around a quarter (27 per cent) of 18 to 30 year olds in London say they are in debt all the time.

- A third of all users of high-cost loans are 18-34 year olds.

Banking

Anything that gets young people engaging with the tools to manage their money is a good thing. However, just having a bank account will not protect young Londoners from falling into debt or becoming victims of fraud – they need to know how to use it and make informed decisions.

According to the Financial Conduct Authority, just 5% of 18-24 year olds are unbanked, yet we still have these damaging stats.

MyBnk believes the Mayor of London has to adopt an education first mentality across monetary and digital skills to ensure young Londoners can tackle the serious housing and debt challenges they face. The City gets it: The Tax Incentivised Savings Association has brought together 20 leading investment firms to support our expert-led primary school lessons in ‘Kickstart Money’.

Guy Rigden, CEO, MyBnk said:

“We need to look holistically at solutions that work, are impartial and properly funded. Let’s prepare young people to prosper in the real world and London’s leading role in it.”

Caroline Russell AM, Chair of the Economy Committee, said:

“It is absolutely crucial that young people are given the right support in terms of their finances, when they leave school. For many, it is the first time they will be responsible for their own money.

Education and support are key, as actions at this critical stage can have real consequences, in terms of credit ratings and long-term financial health. We strongly urge the Mayor to target his efforts in helping this group specifically.”