Earlier this year MyBnk expressed concerns over potential changes to how Personal, Social, Health and Economic Education (PSHE) is taught in English schools.

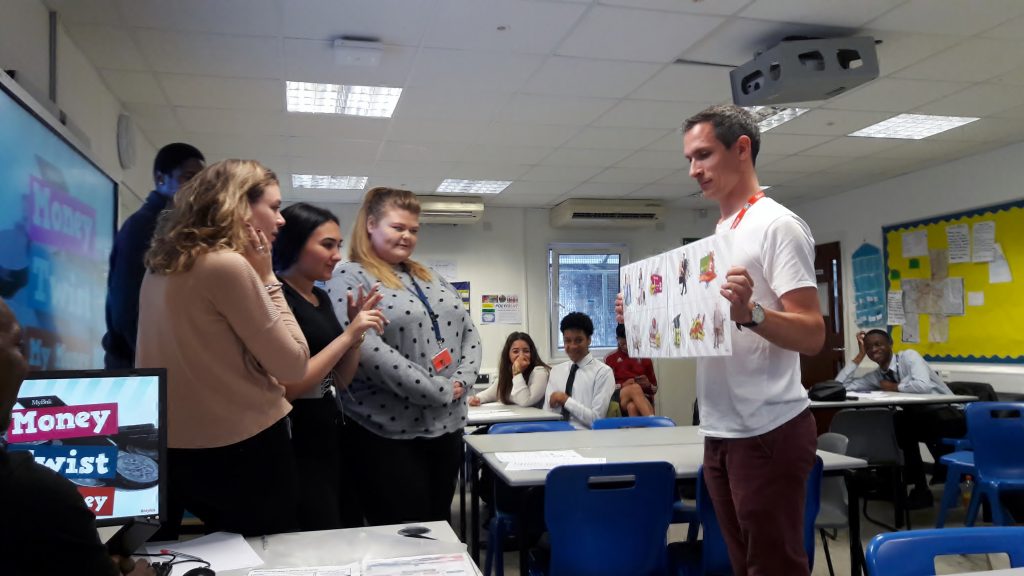

But what do teachers think? Here is a selection of testimonials from those who have run MyBnk’s financial education programmes within their school’s PSHE offering since 2007.

“Learning to take care of your finances is a life skill. One that can potentially have an impact on your quality of life and your mental well-being. Worrying about money can be extremely stressful so if our students have learnt to manage their money early on, it becomes a habit for them, just like we teach about healthy eating.

“It fits in perfectly to PSHE but can also be accessed through maths. The idea of delayed gratification can help pupils with their learning behaviour – work hard now and get out to play early – so this could be beneficial across any subject.

MyBnk’s resources and trainers have made it so easy for us to cover economic well-being – something that has been an aim for me as PSHE coordinator (and it has been raised at pupil voice meetings that they would like more input on this).The range of activities have made it enjoyable and fun for all the children.” Lynette Cook, PSHE Coordinator, Key Stage 2, Foulds School.

“Financial education through PSHE gives pupils the skills that they need to be able to make decisions for themselves, this includes: resilience, self-esteem, risk-management, team working and critical thinking.

“Many of our pupils have told us how they were able to use this as their basic/starting knowledge in Economics and/or Business Studies. Many of our pupils felt that they would not have learnt about this in any other way”. Naznin Bawla, Head of Personal Development Curriculum, Key Stage 3 / 4, Barking Abbey School.

“Financial education within PSHE is absolutely an important subject. It provides young people with essential life skills which they may not access outside of school. This can ensure that they are comfortable and secure in their futures. It can help prevent our students from falling into debt, but also being aware of different types of bank accounts which would be key information for their own security later on.

It should be taught in PSHCE because it is providing young people with the skills to develop socially and securely. It also helps contribute in other subjects, such as Maths, Economics, or Business. However, it is also very important for any discussion about finance of the economy which could also include Humanities subjects.

MyBnk helps to pick up on any gaps in knowledge that there may be. Our students are in mixed ability groups and MyBnk can help pick up on any differences in awareness or subject knowledge on this topic.

They make this topic extremely engaging and fun which in turn makes it easier for the students to learn. MyBnk also has a wide scope of knowledge on the subject which makes it more suitable for them to develop it over a range of subjects and teachers.” Mary Lauren Gill, PSHCE Co-ordinator, Key Stage 3, Mossbourne Community Academy.

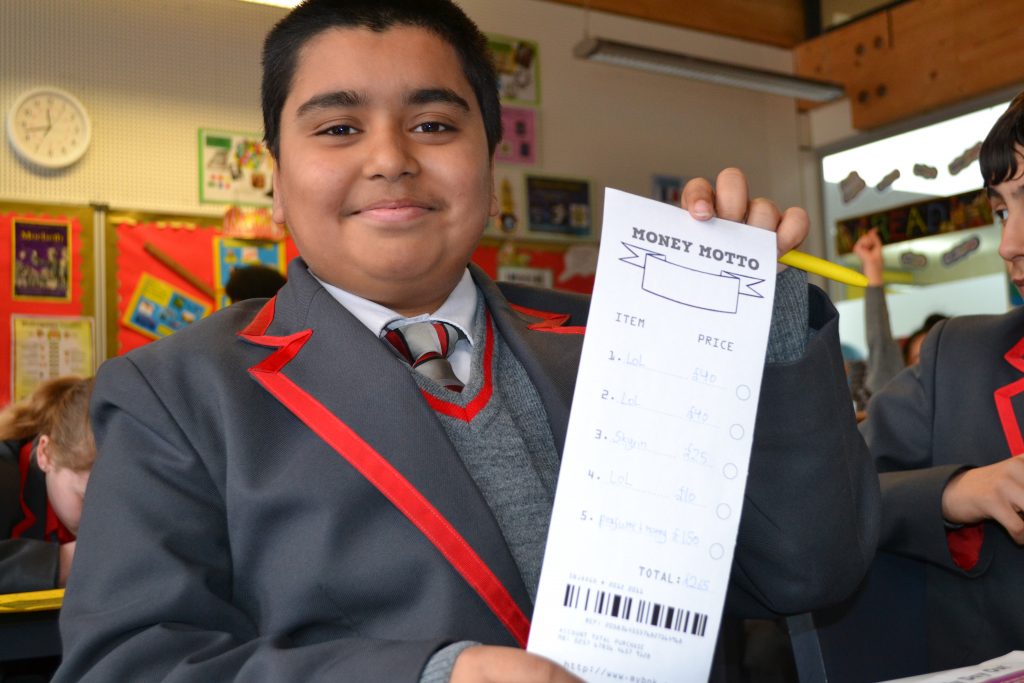

“Financial education is very important for our students. It helps them to understand exactly what financial responsibilities they will face when they are older so they can make the best choices about their future. It also gives them a good understanding of some of the challenges the people that look after them are under and helps them appreciate how important it is to plan for their future.

Delivering the subject through PSHE gives students the opportunity to discuss the issues in a supportive and informative environment. It means students can be clear about the facts and begin to make links with the other subjects they learn. Some of the things they learn can help them think in real terms about mathematical problems.

MyBnk’s bespoke learning opportunities allows individual students to reflect on their specific financial needs and how they may manage their money in the future. Their programme is effectively differentiated and is made relevant through the use of resources useful to our students and their future.” Dominique Quinn, Assistant Principal with responsibility for PSHE, Key Stage 3, Haberdashers’ Aske’s Knights Academy.

In addition to these testimonials we conducted a poll of UK parents, with MUFG bank, revealed most do not believe schools do enough to equip pupils with personal finance skills.

For more information, please visit our Policy page or contact info@mybnk.org.