Financial education for young people in Northern Ireland

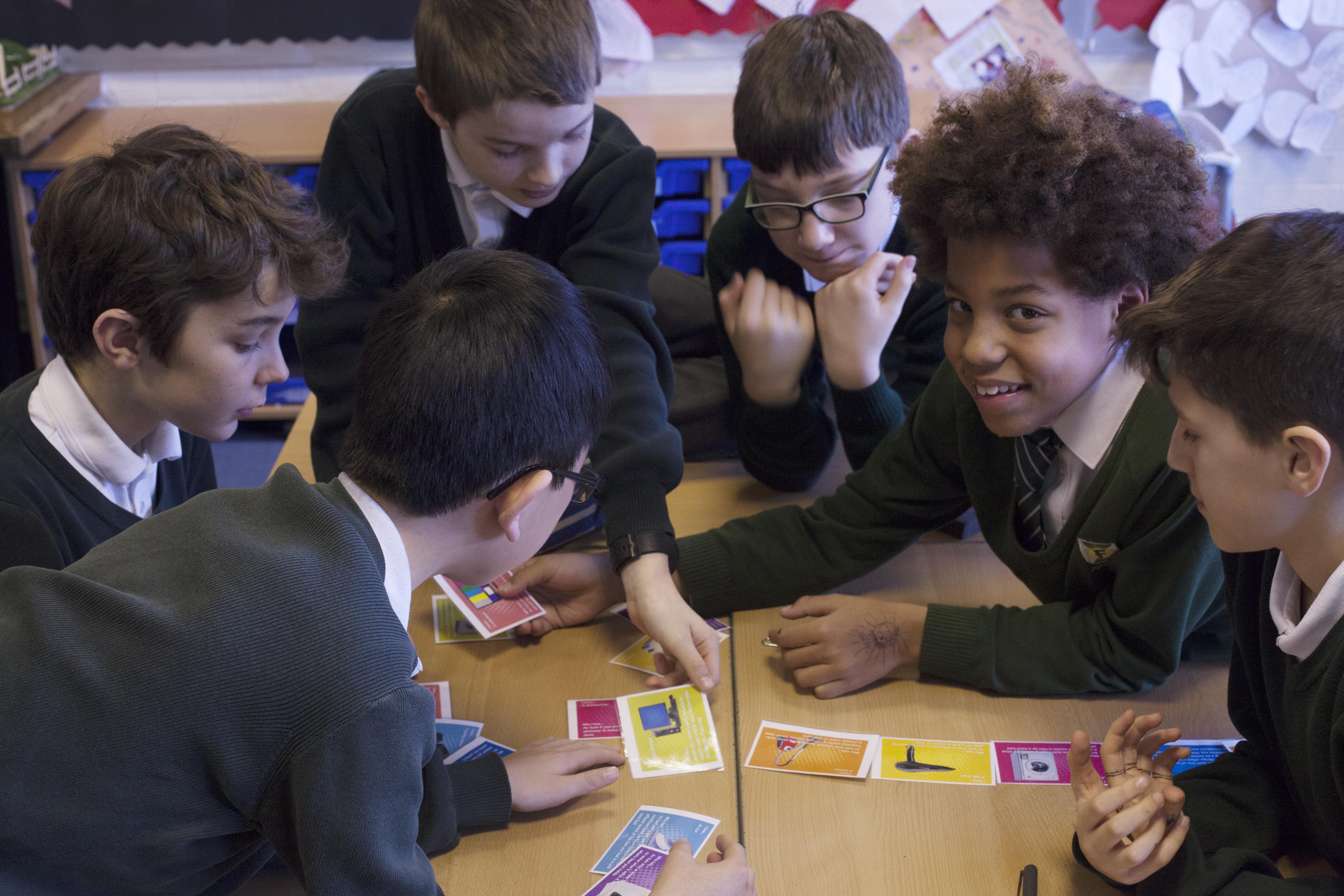

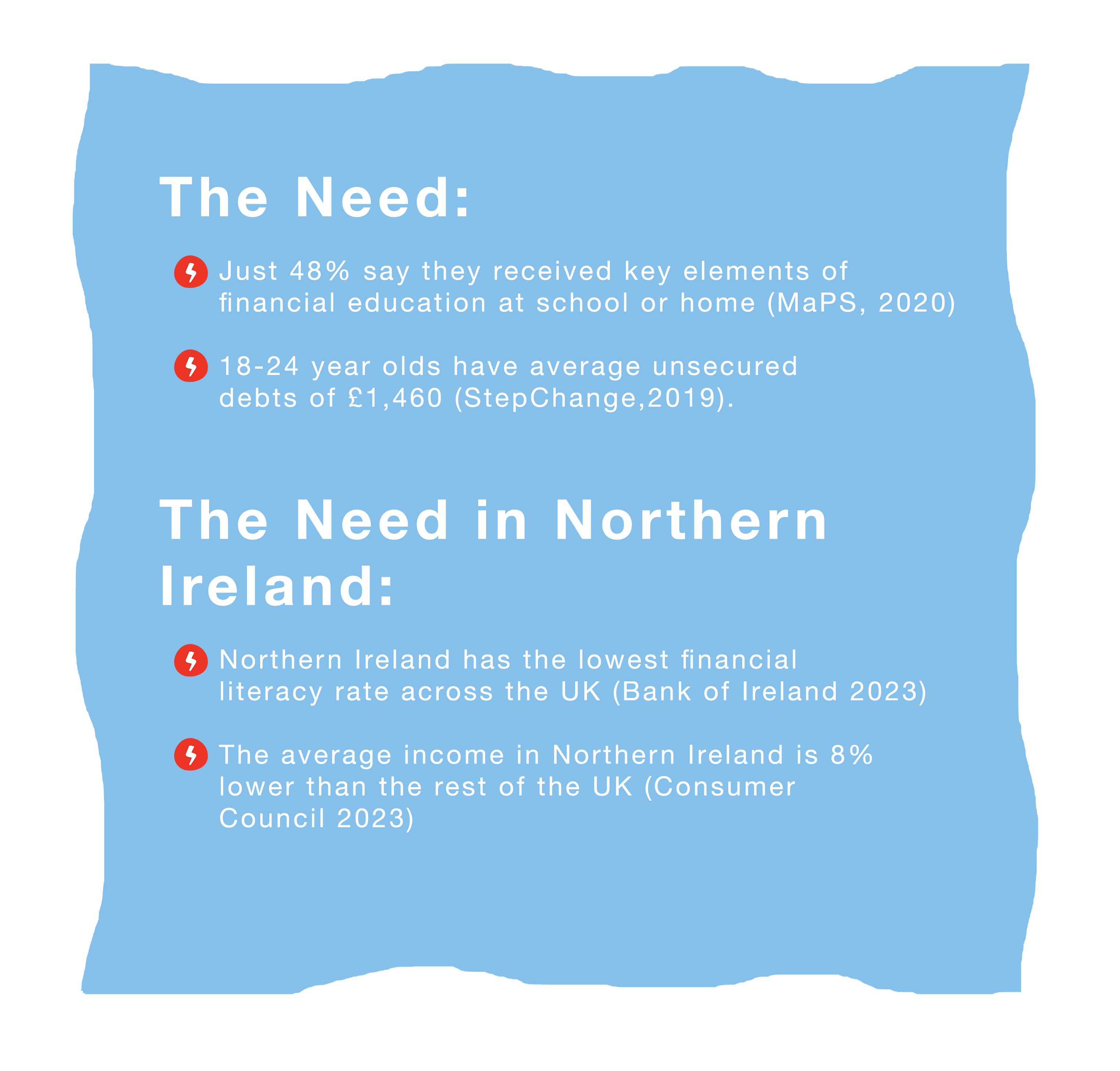

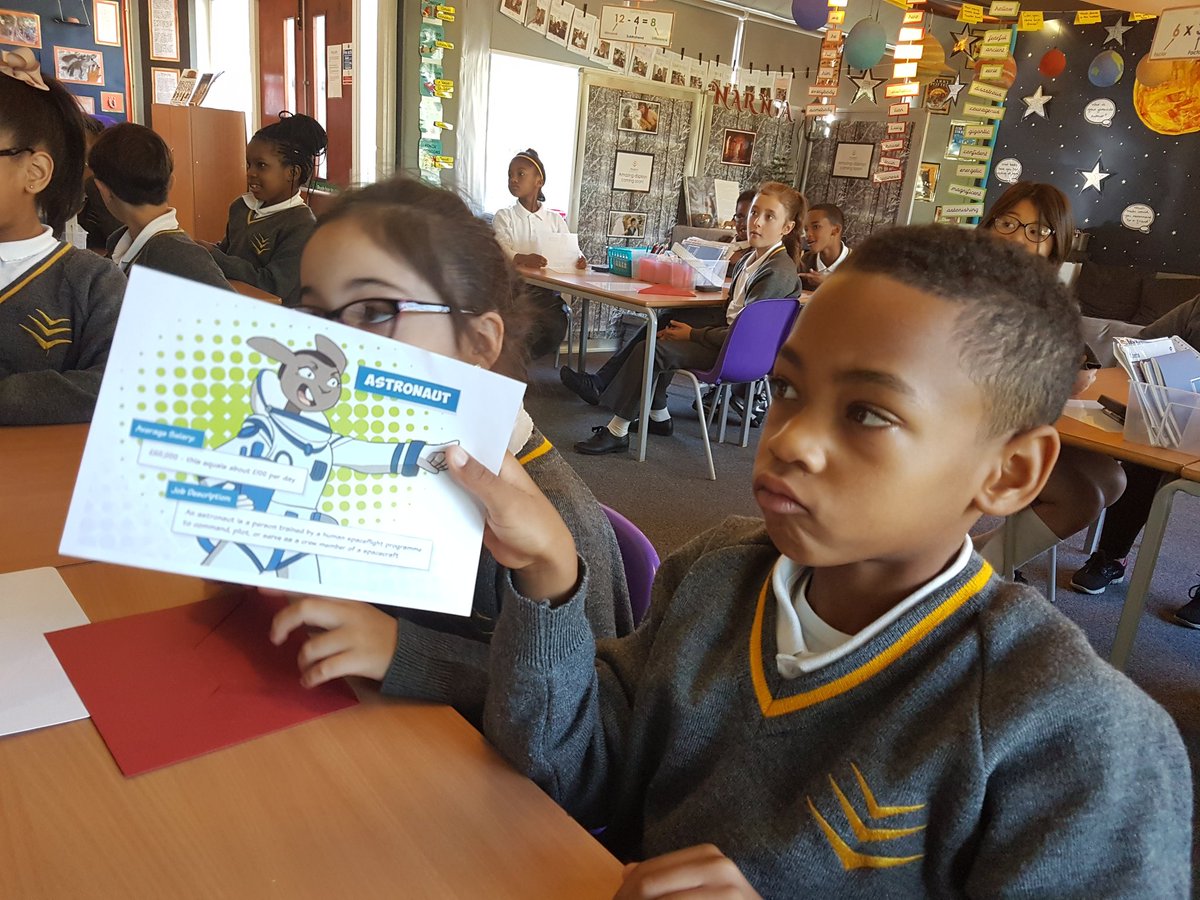

Our expert-led programmes aim to build financial capability at key transitional moments, addressing mindsets, attitudes and behaviours to help young people form an understanding of the wider world of money.

We deliver our Money Twist programme for primary and secondary schools and Money Works to those leaving care, on employability courses or moving/moved into independent living.

Money Works participants will gain a Level 1 Personal Money Management accreditation.

Our Work

View our full suite of programmes available in Northern Ireland, from primary school sessions to young adult programmes.

Contact

To find out more or book programmes for your young people, please contact angela.hillan@mybnk.org.