What are the statutory requirements?

“My learning in mathematics enables me to understand that successful independent living requires financial awareness and effective money management”(BGE)

Financial education is mandatory for students up to S3 in maintained secondary schools via the Broad General Education.

‘Money’ is a key area of the mathematics curriculum for the Broad General Education (BGE). There are a wide range of Benchmarks and Experiences & Outcomes (Es & Os) and MyBnk’s Money Twist programme covers many of these important aspects of the curriculum for classes from P3-P6.

The purpose of the BGE curriculum:

MyBnk’s sessions feed into the overall purpose of the BGE.

- As successful learners, children who have sessions from MyBnk will use numeracy skills to link and apply different kinds of learning in new situations.

- As confident individuals, MyBnk’s sessions will help students to live as independently as they can, assess risk and make informed choices.

- As responsible citizens, our sessions allow students to make informed choices and decisions about their money.

- And as effective contributors, students will solve problems and apply critical thinking in our sessions.

By designing programmes in-house with financial experts, qualified teachers and young people, and delivering sessions direct, we have a unique insight into how material is being received by students and teachers. Many of our programmes are free or funded and can be delivered either directly in-person or as online courses.

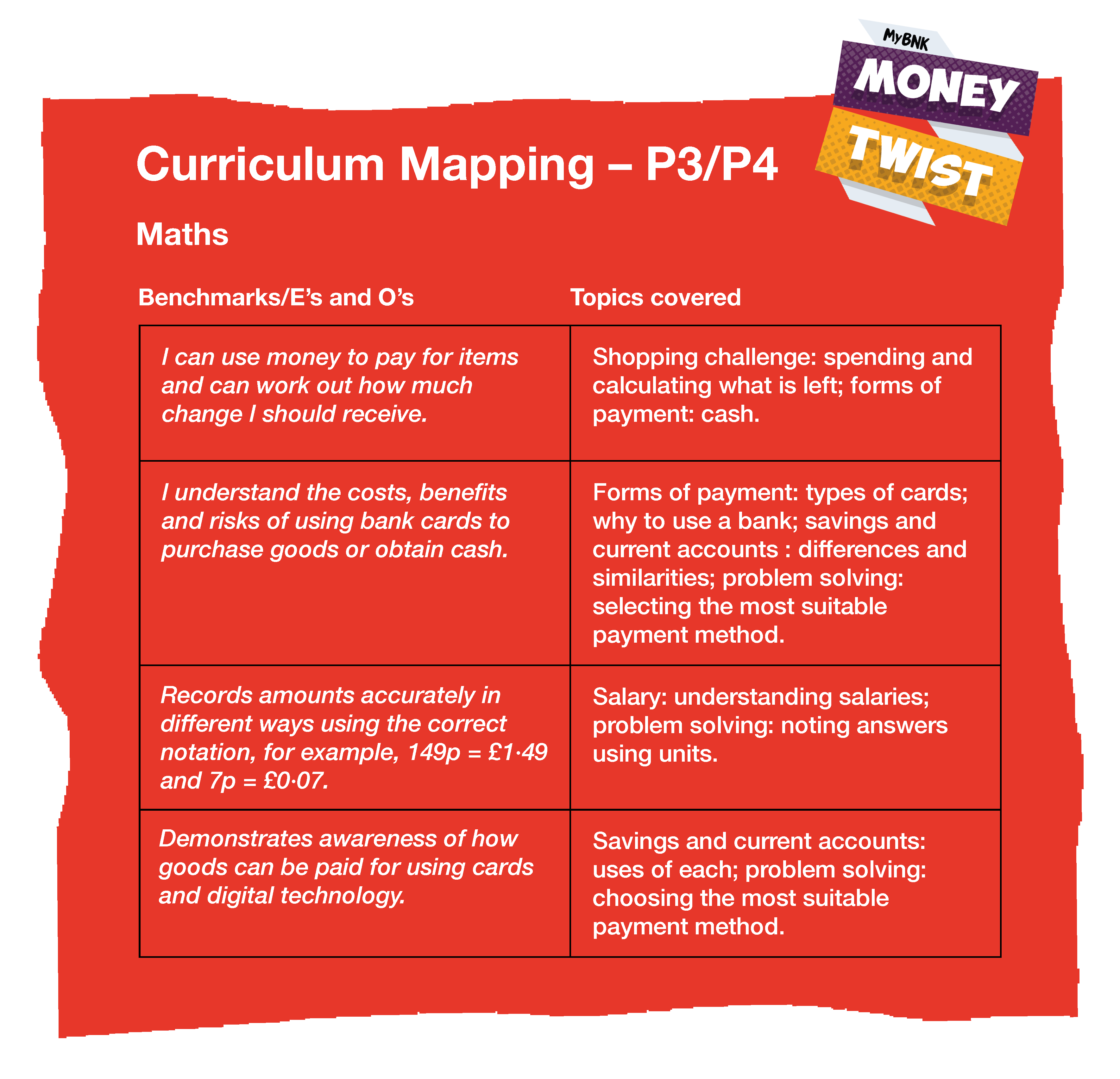

For P3 and P4, we cover the first level benchmarks requiring students to look at ways of accurately recording money using decimals, calculate spending and to have an awareness of how we can pay for items using cards. For the second level benchmarks we delve deeper into using cards as a form of payment and the risks associated with this, as well as the importance of budgeting.

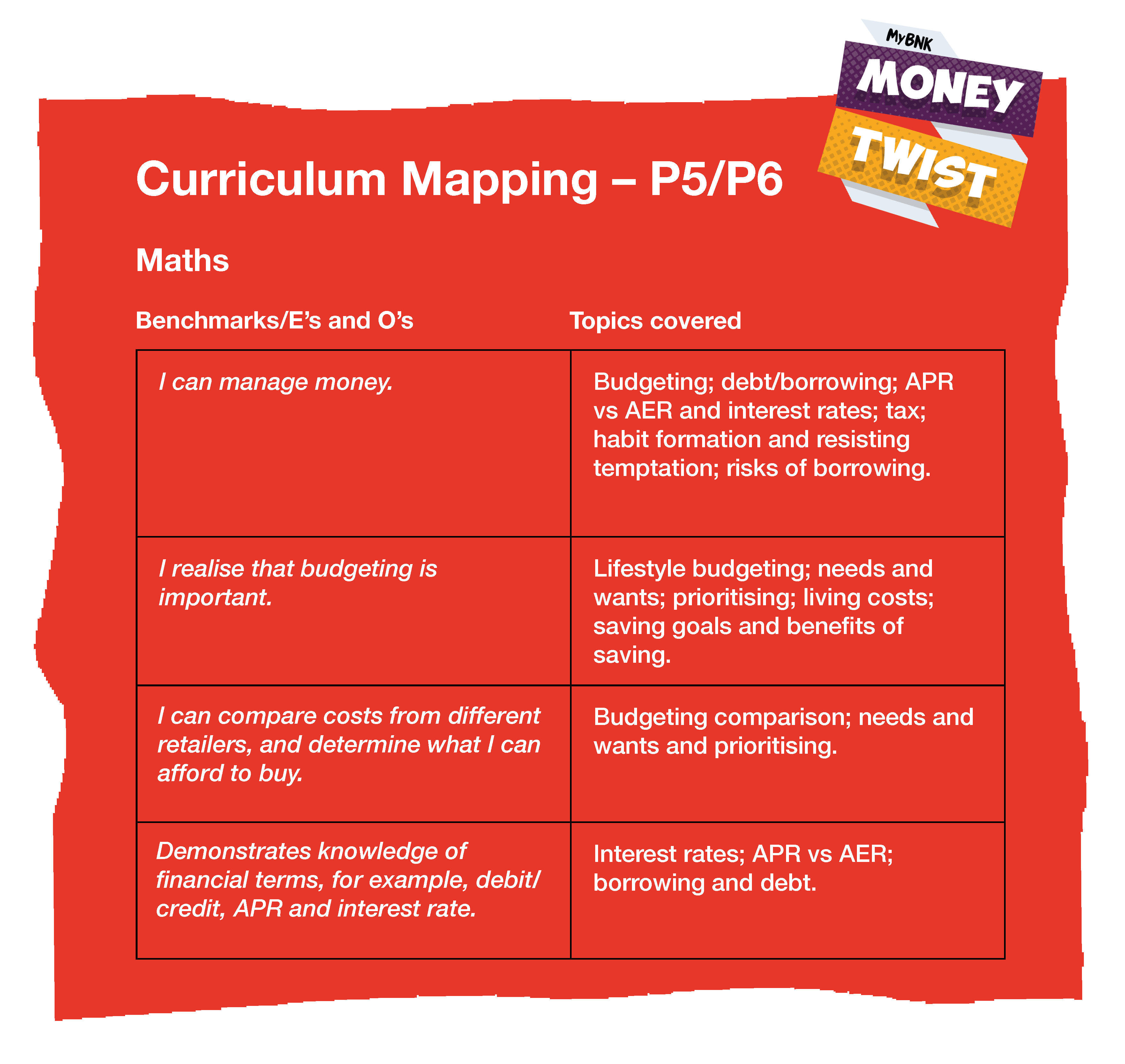

For P5 and P6, we touch on the second level benchmarks requirement for students to carry out money calculations that use all four operations. They should also be able to compare costs and determine affordability within a given budget. The third level benchmark requiring students to demonstrate knowledge of financial terms such as debit/card, APR and interest rates is thoroughly covered in our sessions.

Financial Education Planning Framework

MyBnk has collaborated with members of the Youth Financial Capability Group (YFCG) to create a comprehensive Financial Education Planning Framework for UK teachers. Download your chart for 3-11 and 11-19 year olds.

The YFCG consists of MyBnk, The London School of Business & Finance, Young Money, The Money Charity, The National Skills Academy and Money Advice Service.