Format

3 x 75 minute sessions delivered over 6 weeks – 1 x Assembly – Teacher Resource Pack – Family Activity Pack

Target Group

9-11 year olds – P6/7 in Scotland – Lower KS2 also available

Group Size

12-30 young people

Content

A highly interactive financial education programme, designed to help set positive money habits and mind-sets from an early age.

Expert-led sessions are complemented by an assembly, teacher resources and family challenges. These unique and engaging activities teach young people to become informed consumers, savvy savers, and mindful spenders by making finance fun.

Sessions include:

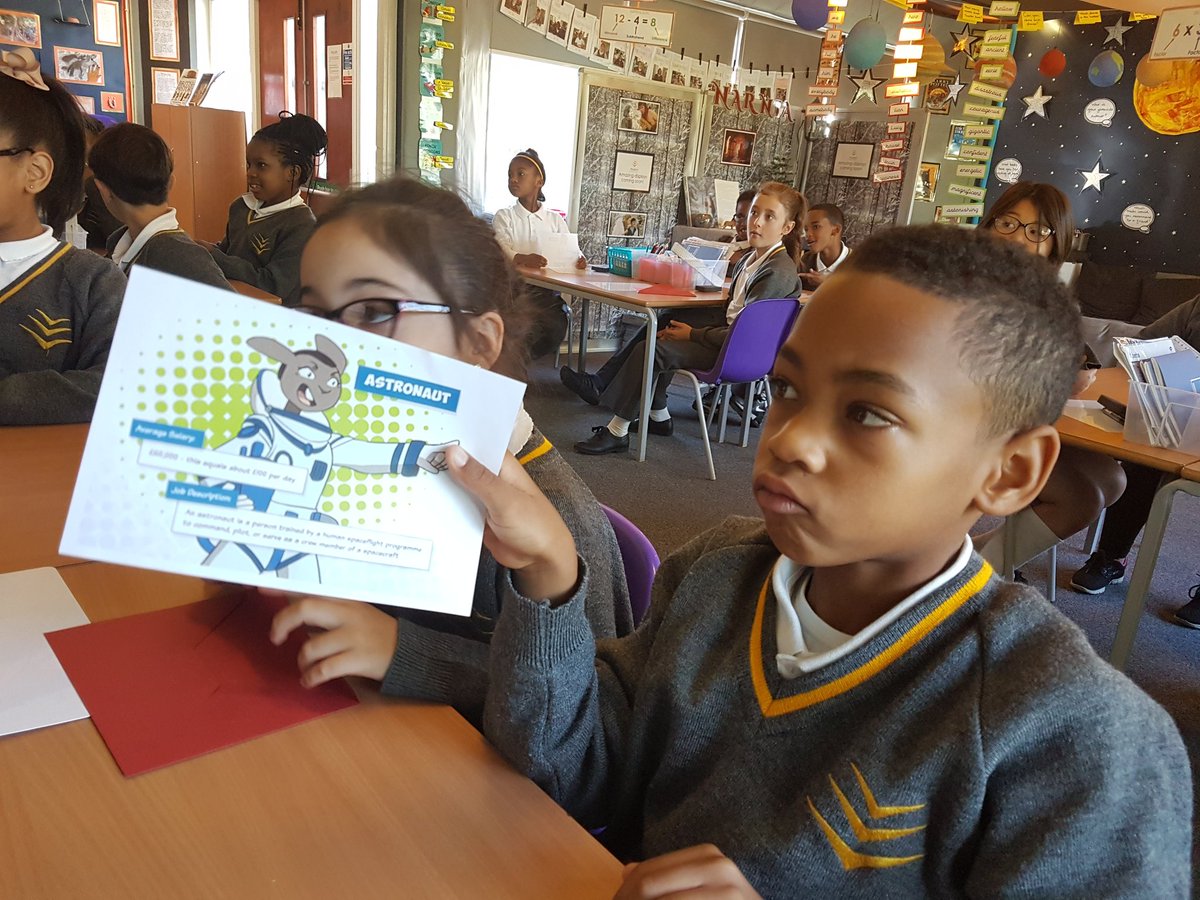

- Assembly: Introduction to different money mindsets related to the consequences of everyday spending and saving.

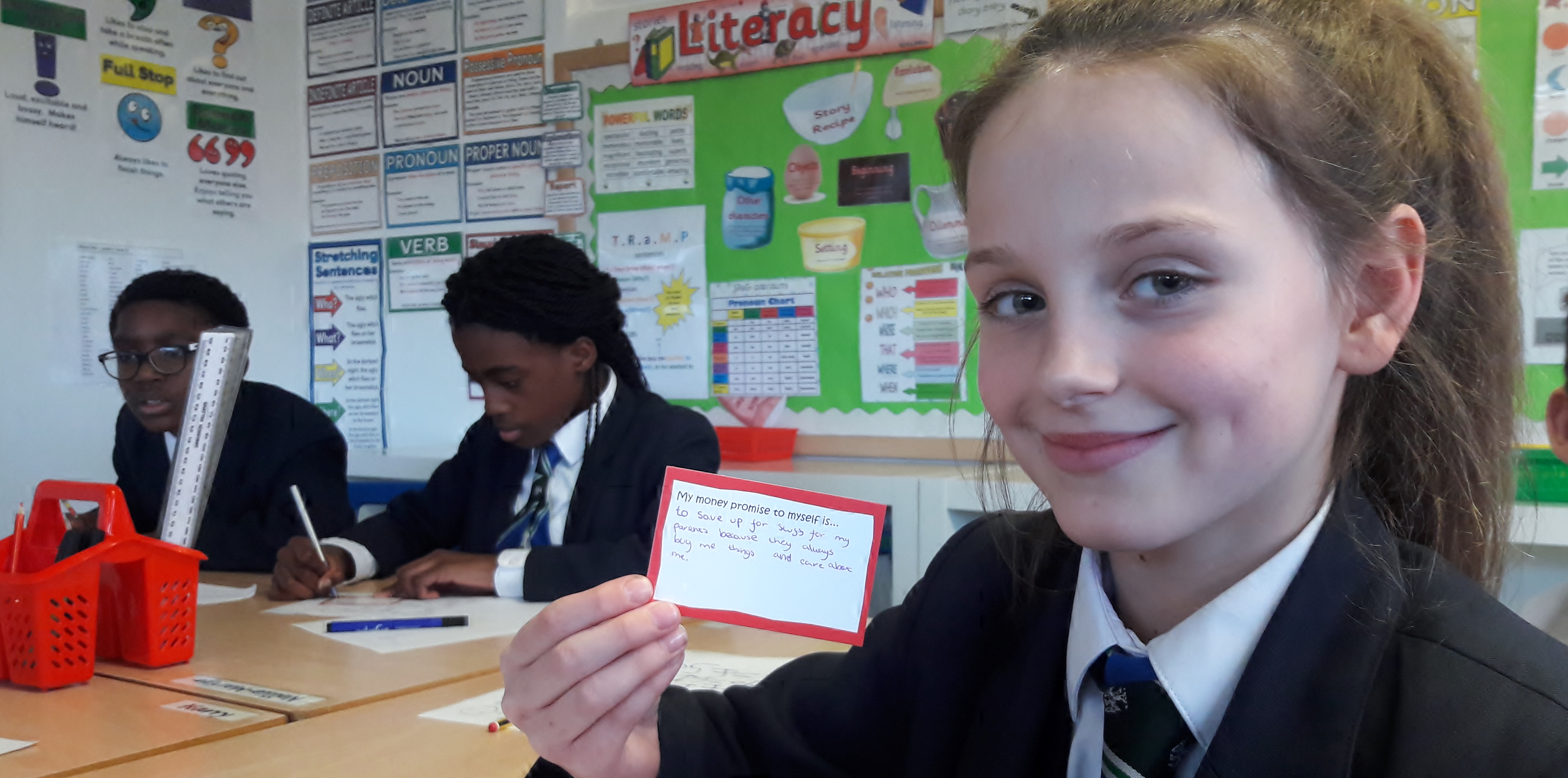

- My Money: Awareness of money habits, delayed gratification and looking at strategies to resist temptation when spending.

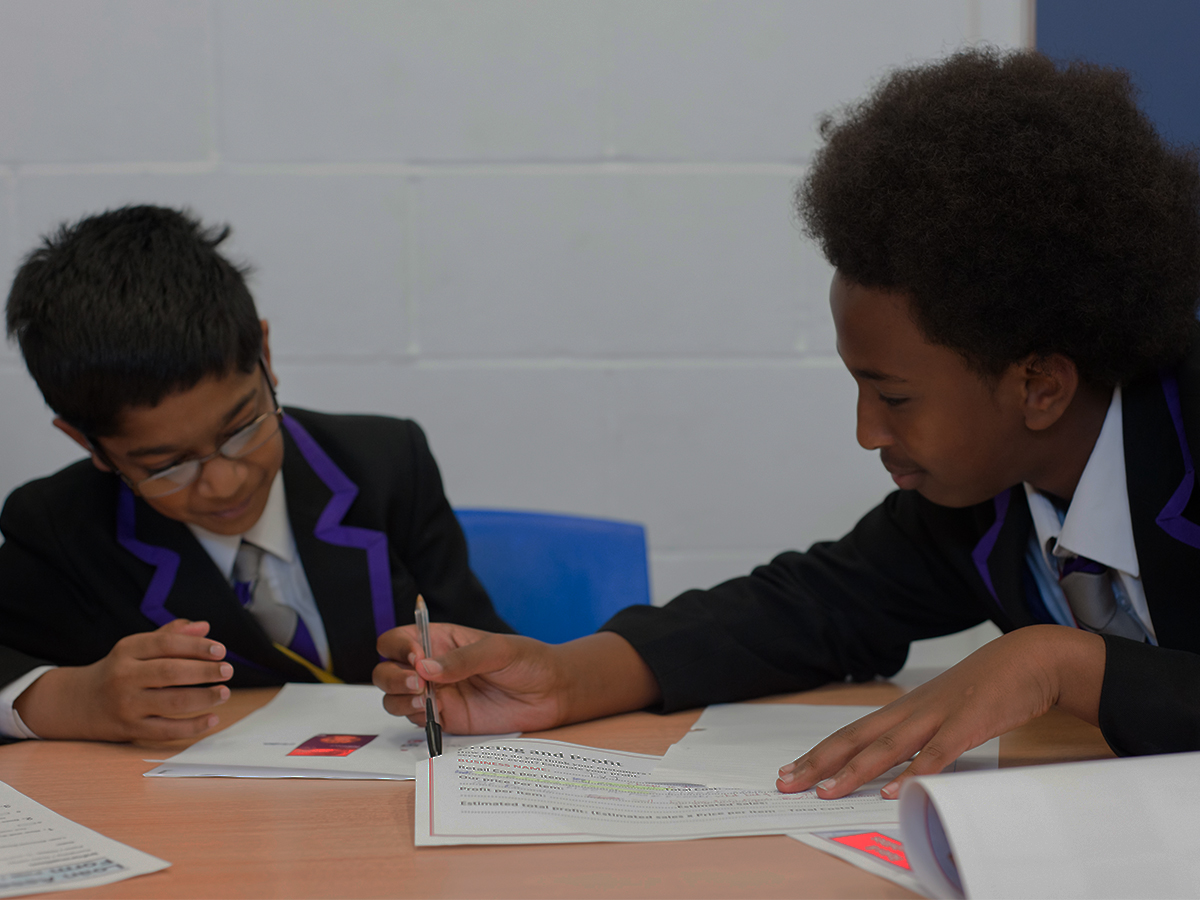

- My Choices: Prioritising needs and wants, the cost of living and exploring how to manage your money through budgeting.

- My Future: The benefits of saving, understanding interest as both a reward for saving and a charge for borrowing. Looking at different financial risks and setting a future finance goal.

See how this programme maps into the National Curriculum and references the UK’s Financial Education Planning Framework for teachers. Online versions also available.

Money Twist involves writing, presenting, drawing, maths and problem-solving. We use interactive resources and videos, engaging students to remember new knowledge and form their own money opinions. Underpinning behaviour change is the development of executive functions.

Impact

Money Twist has been evaluated and proven by The Money Advice Service’s Evidence Hub.

MyBnk Cancellation Policy: Cancellations and changes made to scheduled deliveries incur costs to MyBnk. Any changes made less than two weeks in advance will result in a £100 or, if less than three working days, £250 charge per MyBnk trainer. Full Terms & Conditions here.

Impact After This Programme

68

Pupils who would not delay gratification, now would

70

Pupils are now pursuing a savings goal

87

Teachers who said pupils now know financial decisions have consequences