Format

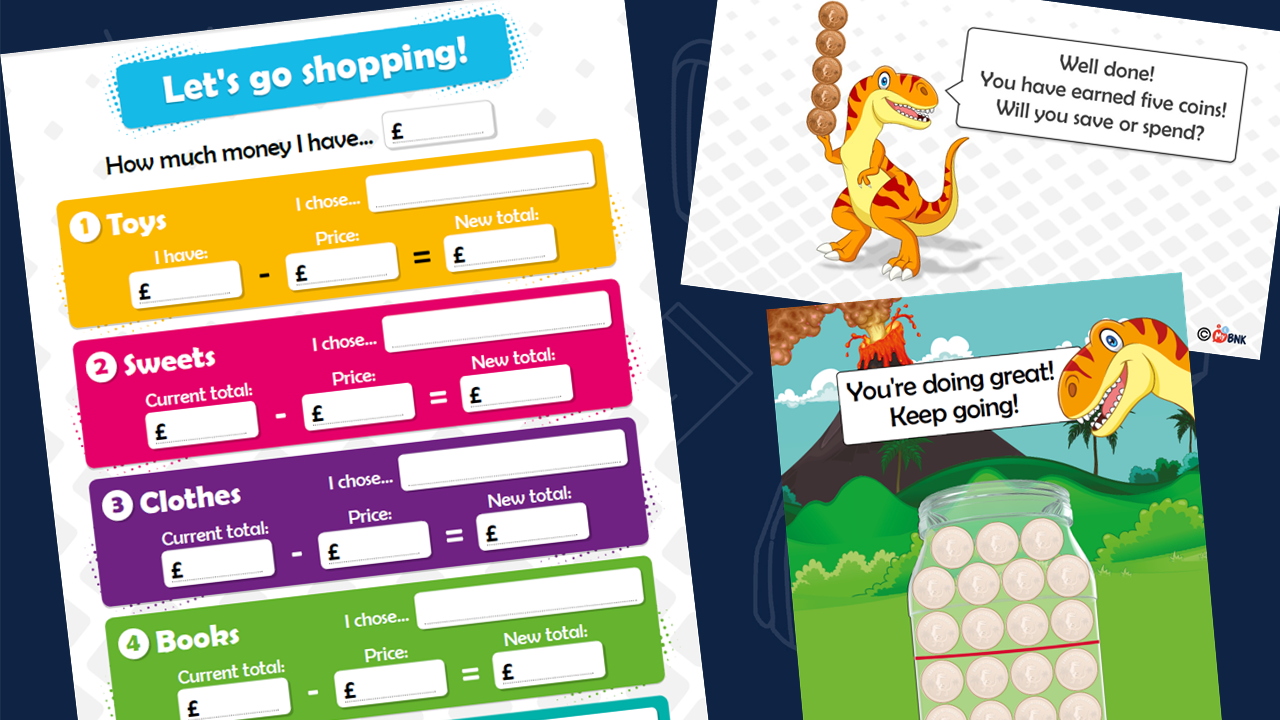

Videos, quizzes and activities for 5 x 30 minute sessions – Includes a Save-o-saurus Rex money poster to work towards a savings goal over the sessions – Can be incorporated into adapted curriculums

Target Group

P1/2

Group Size

Any

Content

A highly interactive free digital financial education programme – designed to help children set positive money habits and mind-sets from an early age.

Created by experts, activities, including games, videos and role play, gets the family talking about personal finance. These sessions improve children’s understanding of the value of money and delayed gratification by making spending and saving decisions and gaining rewards.

This package of support brings money to the dinner table and tackles often difficult topics such as income and the household finances. Research shows lifelong money habits can be formed by the age of 7.

Sessions cover:

- Where Money Comes From: Ways of earning money.

- Practical Value: The cost of everyday items and the value of things in a home.

- Needs and Wants: Understanding needs and wants, making choices with money and resisting temptation.

- Keeping Track of Money: Why it is important to keep track of spending and how to do it.

- Saving: Why it is important to save.

Family Money Twist involves maths, drawing, literacy skills and drama. It helps children start their financial education journey and build on new knowledge in a fun and structured way.

We also offer an online P3-6 and S1-3 independent learning programme.

These digital products complement our Money Twist primary school offering, a series of sessions for both P3/4 and P5/6 pupils, delivered directly by our expert trainers.

Impact After Our Programmes

68

Of pupils who would not delay gratification, now would

70

Of pupils are now pursuing a savings goal

87

Of teachers said pupils now know financial decisions have consequences

"Better spend an extra hundred or two on your son's education, than leave it him in your will." ~ The Mill on the Floss by George Eliot