Format

3 x 60 minute sessions – Expert-led videos guide children through sessions – Main activity includes games and quizzes – Choice of ‘Make it’; ‘Say it’; or ‘Write it’ task to finish each session

Target Group

P3-6 pupils

Group Size

Any

Content

An online independent learning programme that teaches P3-6 pupils the basics of money whilst setting positive money habits.

These financial education resources are designed for direct use by children, with actionable ‘tell/ask/show your parent’ activities to prompt important conversations throughout the home. They can be introduced via families or a teachers’ adapted curriculum.

Three interactive sessions of videos, games and quizzes see children gain budgeting skills and develop an understanding of delayed gratification by creating saving goals.

Sessions cover:

- Needs and Wants: Where money comes from, and understanding common needs and wants found in the home.

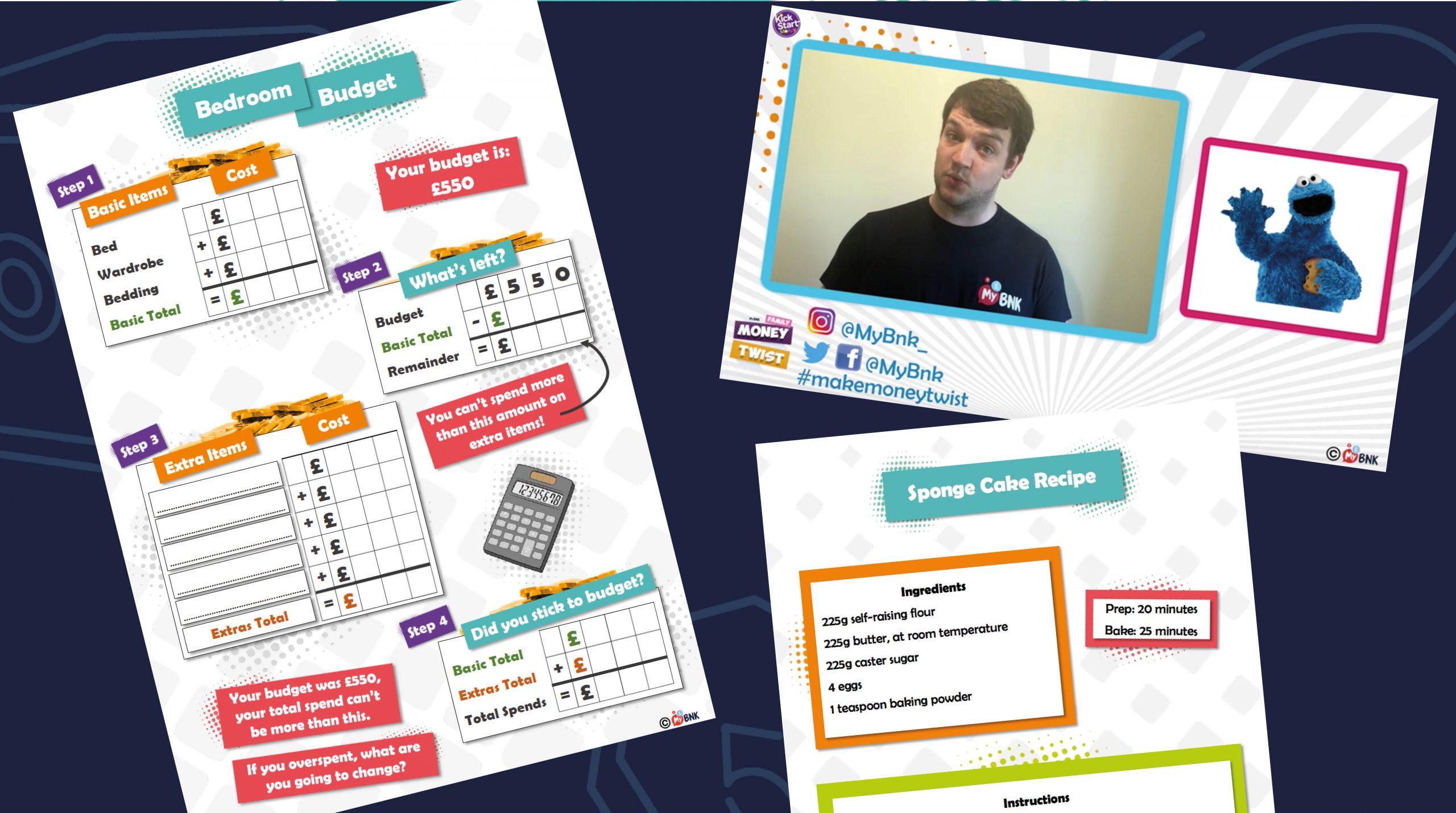

- How to Budget: Understanding the importance of budgeting, and creating a budget for bedroom decoration.

- Saving and Delayed Gratification: Exploring the concept of delayed gratification and creating personal saving goals.

The programme involves maths, art, drama and literacy skills. Children can choose a task that compliments their learning style, through age and ability, with our ‘Make it, Say it, or Write it’ options in each session.

In-person versions for P3/4 and P5/6 also available along with an online P1-2 parent / teacher-led programme.

Impact After Our Programmes

68

Of pupils who would not delay gratification, now would

70

Of pupils are now pursuing a savings goal

87

Of teachers said pupils now know financial decisions have consequences

"Better spend an extra hundred or two on your son's education, than leave it him in your will." ~ The Mill on the Floss by George Eliot