Format

3 x 60 minute sessions – Expert-led videos guide children through sessions – Main activity includes games and quizzes – Choice of ‘Make it’; ‘Say it’; or ‘Write it’ task to finish each session

Target Group

7-11 year olds – P4-6 in Scotland

Group Size

Any

Content

An online independent learning programme that teaches 7-11 year olds the basics of money whilst setting positive money habits.

These financial education resources are designed for direct use by children, with actionable ‘tell/ask/show your parent’ activities to prompt important conversations throughout the home. They can be introduced via families or a teachers’ adapted curriculum.

Three interactive sessions of videos, games and quizzes see children gain budgeting skills and develop an understanding of delayed gratification by creating saving goals.

Sessions cover:

- Needs and Wants: Where money comes from, and understanding common needs and wants found in the home.

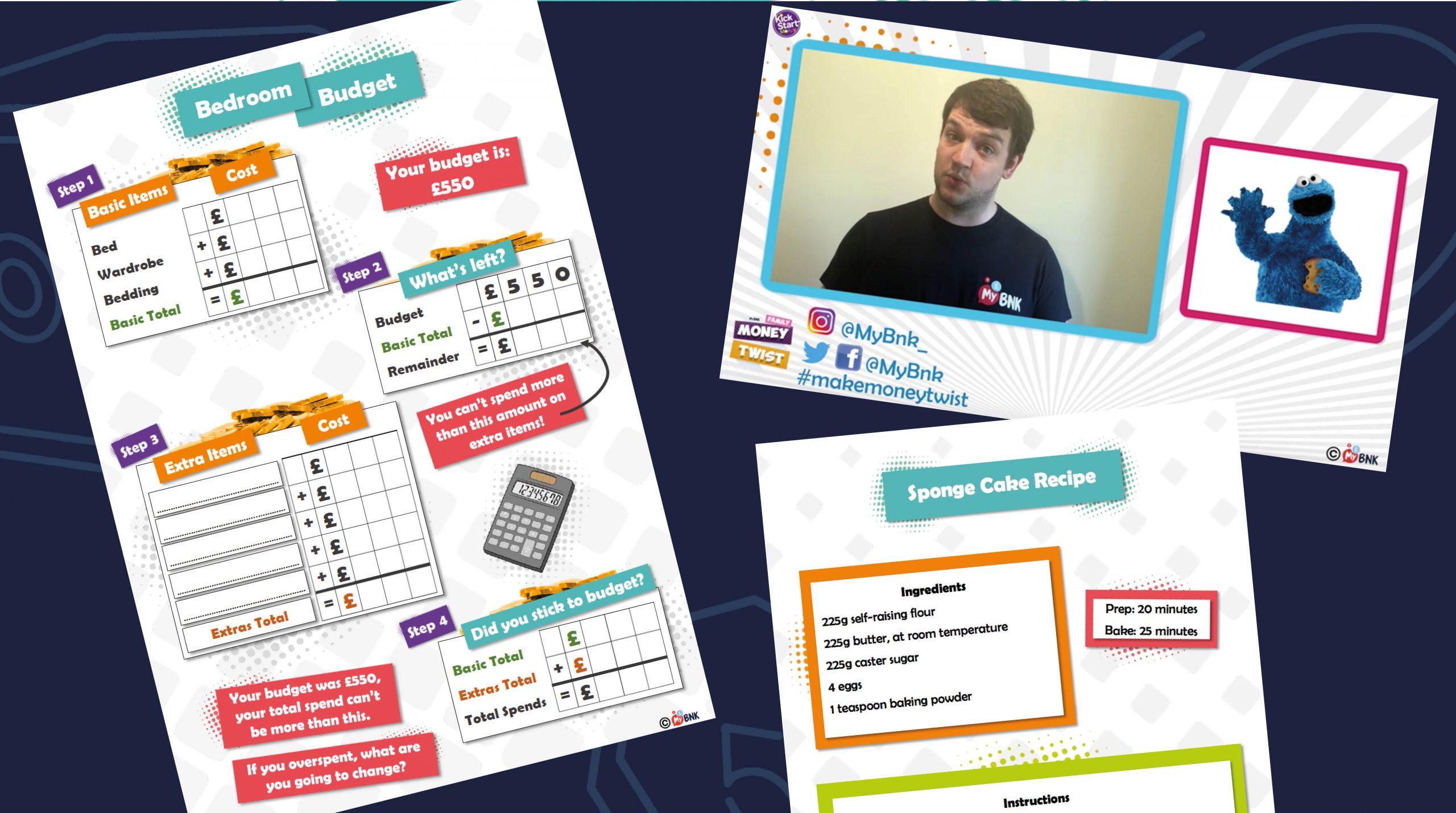

- How to Budget: Understanding the importance of budgeting, and creating a budget for bedroom decoration.

- Saving and Delayed Gratification: Exploring the concept of delayed gratification and creating personal saving goals.

The programme involves maths, art, drama and literacy skills. Children can choose a task that compliments their learning style, through age and ability, with our ‘Make it, Say it, or Write it’ options in each session.

In-person and virtual versions are also available along with a online Years 1-2** parent / teacher-led programme.

*P1-2 in Scotland

Impact After Our Programmes

68

Of pupils who would not delay gratification, now would

70

Of pupils are now pursuing a savings goal

87

Of teachers said pupils now know financial decisions have consequences