Format

Resources and lesson plans for 5 x 45 minute sessions over five weeks (optional extension for key recognition skills) – 30 minutes of online CPD providing a contextual overview of materials before sessions

Target Group

5-7 year olds – MyBnk-led sessions for KS2 phases also available

Group Size

12-30 young people

Content

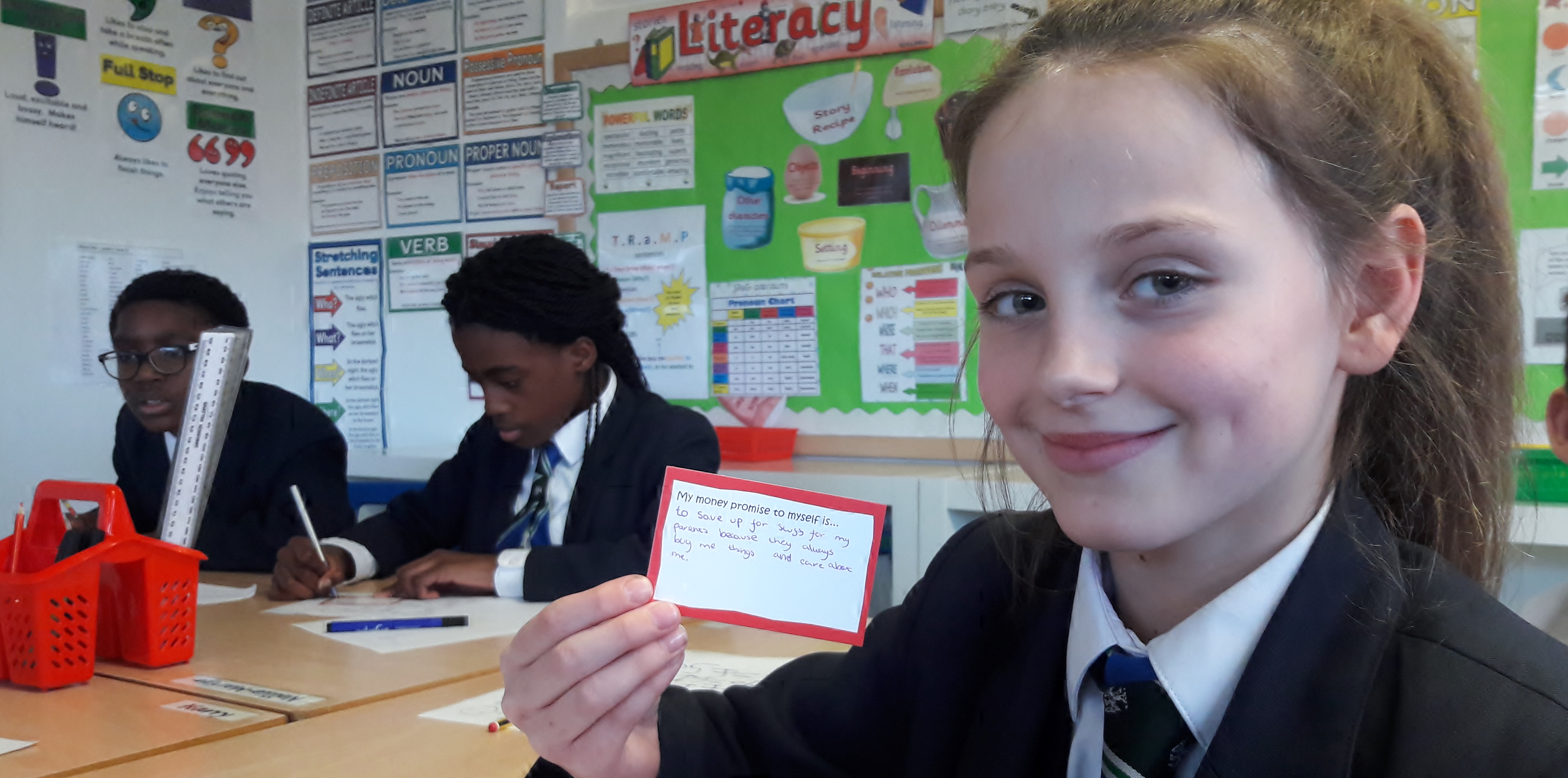

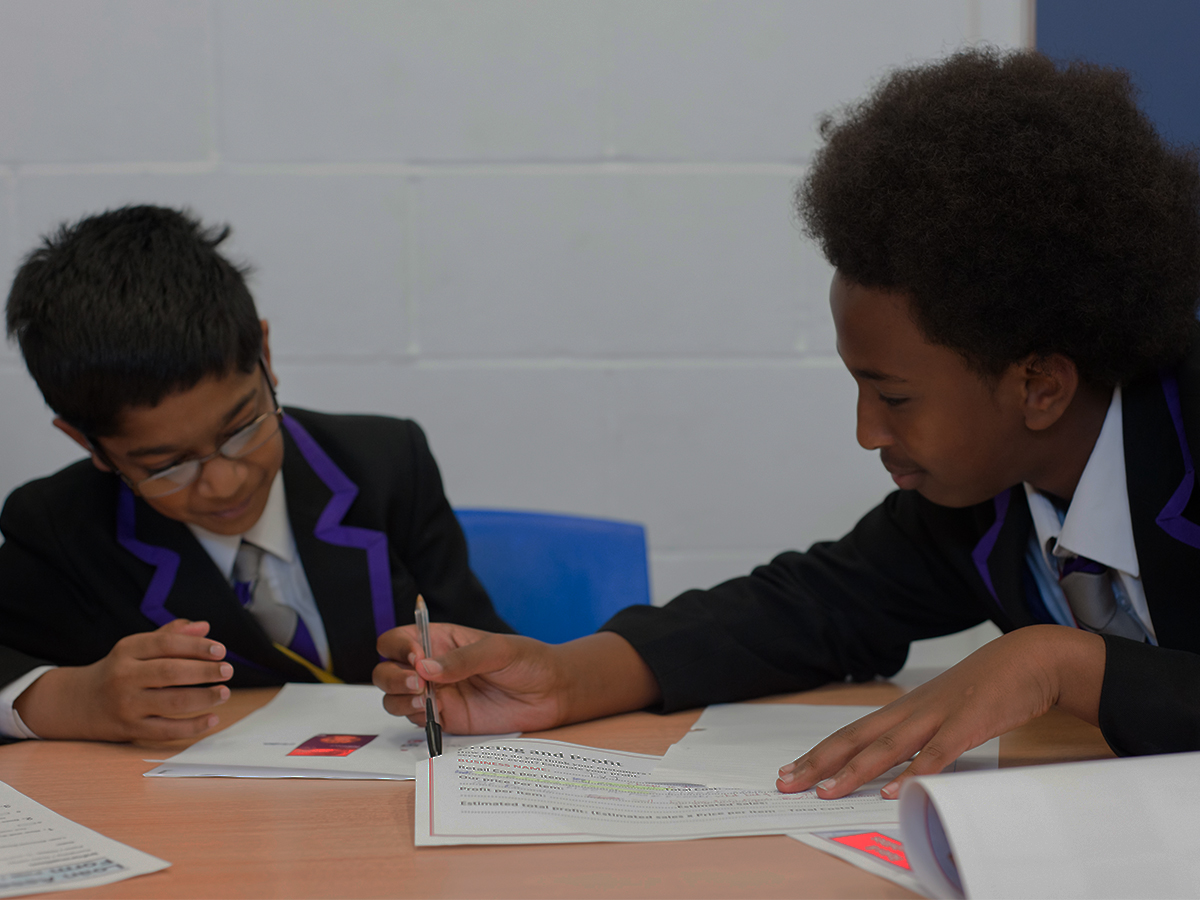

A highly interactive teacher-led financial education programme designed to help set positive money habits and mind-sets from an early age.

Complemented by online Continuing Professional Development (CPD) and a suite of downloadable resources and lesson plans.

Designed by experts and young people, activities, including games and role play, teach children to understand delayed gratification and set money goals by making saving and spending decisions and gaining rewards.

This package of support aims to forge and encourage positive money behaviours. Research shows lifelong money habits can be formed by age 7.

Sessions cover:

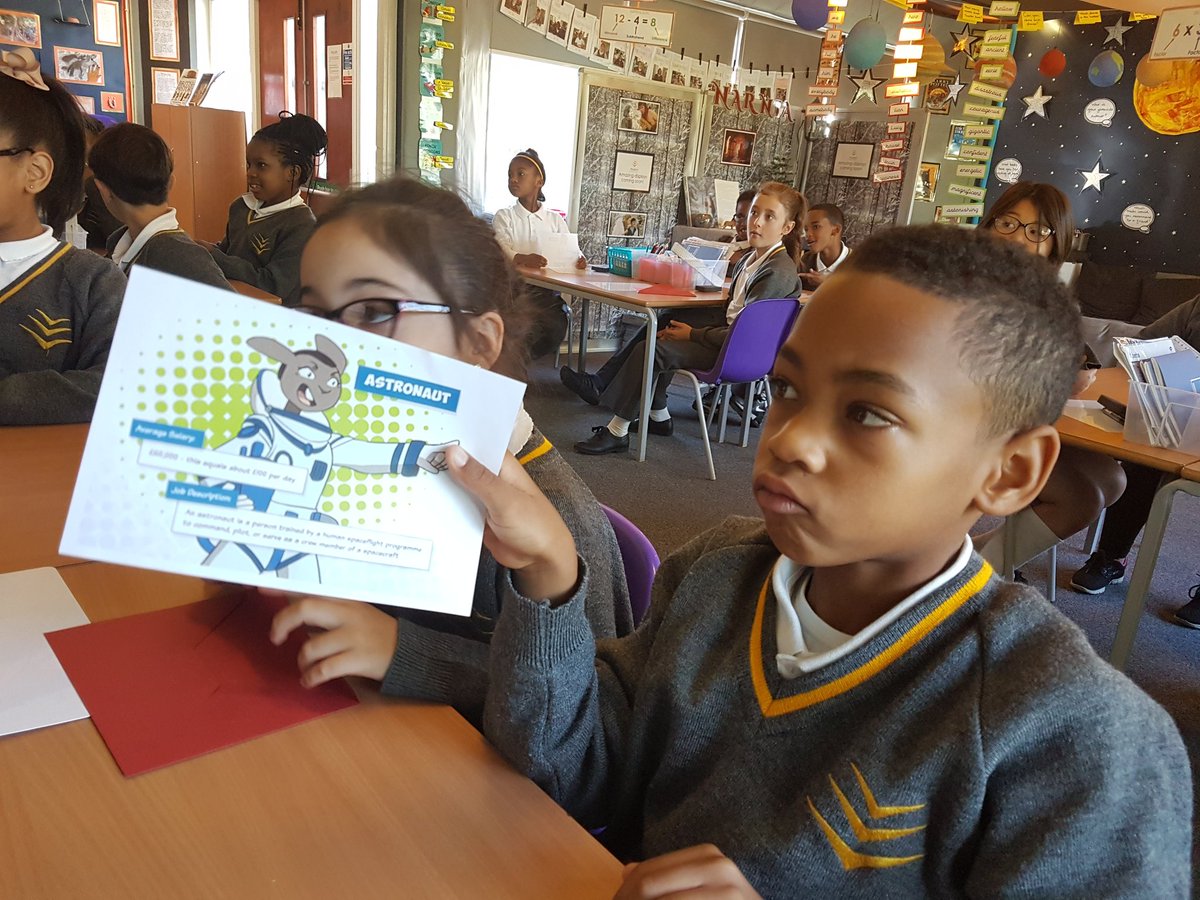

- Where Money Comes From: Earning money and why we use it.

- Practical Value: The value of notes and coins in the real world and the cost of everyday items.

- Going Shopping: Understanding needs and wants, making choices with money and resisting temptation when shopping.

- Keeping Track of Money: Why it is important to keep track of spending and how to do it.

- Saving: Understanding where to keep money and why it is important to save.

See how this programme references the UK’s Financial Education Planning Framework for teachers.

Money Twist KS1 involves maths, drawing, problem solving and drama. It engages students to form their own opinions on money and build on new knowledge.

MyBnk also delivers Money Twist KS2 which has been independently evaluated and proven by The Money and Pension Service’s Evidence Hub.

Impact After Our Programmes

68

Of pupils who would not delay gratification, now would

70

Of pupils are now pursuing a savings goal

87

Of teachers said pupils now know financial decisions have consequences