Does financial education work? Prove it!

MyBnk takes measuring the impact of our financial education programmes for young people very seriously.

Our work is designed to provide short, intensive educational experiences that ‘join the dots’; and build up existing capabilities. From the ages of 5-25, we develop young people’s core knowledge and skills, boosting their confidence to successfully apply their learning and take positive steps in their lives.

MyBnk uses an outcomes-based monitoring and evaluation system with teachers, facilitators and young people, employing a range of data-collection methods to evaluate the effect of our workshops. We collect data at baseline, endline, and follow up points, comparing to control data from non-participants. Quantitative data is supplemented with qualitative interviews and focus groups with a range of stakeholders. Where possible, we access data associated with individuals, such as their rent arrears, evictions and movement into employment and training. Programmes are also scrutinised by external evaluators who set their own impact measurement criteria and have access to our sessions and stakeholders.

Our new Making a Meaningful Impact document summarises these studies:

- Schools Age – Increasing savings – Primary Schools.

- Schools Age – Delayed gratification – Primary Schools.

- Young Adults – Preventing Youth Homelessness.

- Young Adults – Elevating the Playing Field.

New - Independent Evaluation - Overcoming UK children's low financial capability - Money Twist KS2 - 2019/20

“What’s a wage?”

A new report shows most children in the UK do not know what a wage is.

A new report shows most children in the UK do not know what a wage is.

The findings of the KickStart Money programme, delivered by MyBnk, uncovered several worrying early indicators of poor financial capability. However, it also proves intervention can successfully target the executive functions behind money management i.e. habits, attitudes and behaviours.

The yearlong independent study of over three thousand 7-11 year olds taking part in the MyBnk ‘Money Twist‘ lessons found:

- Three out of five struggle with basic personal finance terminology.

- Barely a third can delay instant spending gratification.

- Just 19% save money regularly.

- Only 30% think how they treat money now will have an impact on their future.

Children from areas of high free school meals were found to have the lowest financial capability – after financial education they closed the gap with their peers.

Executive functions

According to evaluators Substance, three months after the programme, 69% of children are working towards a savings target and 60% think how they treat money now will affect them in the future.

Independent evaluators also found:

- 77% of children who could not delay spending gratification now can.

- 75% who could not separate their needs and wants now can.

- 83% of those who could not correctly identify what a budget was, now can.

- A 17% to 83% rise in teachers’ understanding of what makes good financial education.

Money lessons are not compulsory in English primary schools. Just 52% of 7-16 year olds recall receiving any form of money lessons according to the Money and Pensions Service.

Key documents: Full story – Full report – Press release.

MyBnk Analysis - Closing the UK’s youth gender financial capability gap - Money Twist KS3 & Money Works - 2019/20

Confidence and mental health

MyBnk have detected worrying early indicators of a gender-based financial capability gap in the UK.

MyBnk have detected worrying early indicators of a gender-based financial capability gap in the UK.

Analysis of 3,700 11-25 year olds taking part in our programmes over a year found young females have less financial confidence and suffer more money related mental health issues than males. This capability gap is starker at school age, however, with intervention, closes and later overtakes the abilities of males.

MyBnk found nearly half of girls (43%) were not financially confident, 18% less so than boys. And 10% more of young women suffered anxiety and depression about money than their male counterparts.

After expert-led lessons with 16-25 year olds we found a 48% increase in regular saving and a 40% decrease in owing money – versus a 29% rise in saving and 31% drop in debt for men.

Of 14 indicators from across a range of financial capabilities, 11-16 year old girls have a higher starting position in just four over boys and spend more money on their wants (17%) and less money on their needs (11%) than males.

Key documents – Full story

Independent Evaluation - Increasing savings and financial capability - Money Twist KS2 - 2018/19

Making financial education ‘sticky’

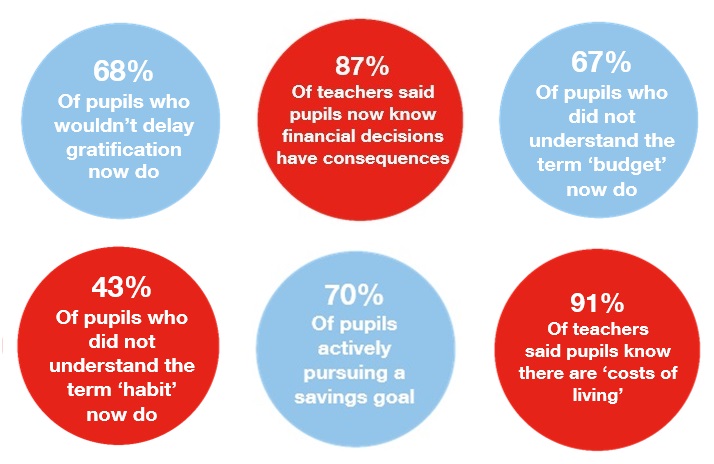

Two out of three UK primary school pupils actively work towards a savings goal after receiving MyBnk programmes – double the national average of 34%.

Two out of three UK primary school pupils actively work towards a savings goal after receiving MyBnk programmes – double the national average of 34%.

One year after intervention, 70% stick to their money plans.

Independent evaluators, Substance, discovered our Money Twist sessions for 7-11 year olds resulted in key financial capabilities increasing over time.

Adult money habits form from age 7, including understanding the value of money and complex functions such as planning ahead. The UK household saving ratio remains at a historically low level. Despite this, there are no compulsory money lessons in English primary schools.

Mindsets

Sessions address money mindsets, attitudes and behaviours, consumer choices and key skills and knowledge such as budgeting and prioritisation. MyBnk ‘brings money to life’ using videos, manga comics, games and role play, drawn from youth culture.

CEOs of the UK’s leading savings and investment firms have written to the Prime Minister to call for compulsory financial education in UK primary schools. The KickStart Money coalition represents 20 outfits supporting MyBnk’s work in primary schools for 20,000 pupils.

Key documents: Report – Infographic – Press Release – Blog.

Independent Evaluation - Teacher/volunteer comparison & Increased financial capability - Money Twist KS3-4 2017/18

Supporting teachers and boosting money skills

Four years after financial education became compulsory in English secondary schools, teachers say outside experts are better placed to deliver the subject, according to our latest independent report.

Four years after financial education became compulsory in English secondary schools, teachers say outside experts are better placed to deliver the subject, according to our latest independent report.

Evaluators Substance found 73% of teachers thought dedicated full time trainers were better able to deliver money lessons than other teachers and 70% thought they were more effective than volunteers. After expert-led sessions 11-16 year olds were found to be 22% more capable of managing money and understanding personal and public finance than control groups.

An 11 month study analysed data from 2,287 pupils and 231 teachers at 86 schools participating in our Money Twist Key Stage 3 & 4 programmes and 4,797 pupils in control groups. The report is part of the £11.9m ‘What Works Fund’ managed by the Money Advice Service (MAS), which is now part of the Money and Pensions Service (MAPS), testing the effectiveness of interventions across the UK.

Capability

After MyBnk’s expert-led intervention there was a:

- 44% increase in resisting ‘instant gratification’ spending.

- 45% shift in extreme spending habits to moderation.

- 31% increase in fraud awareness, such as spotting fake money.

- 22% increase in understanding government finances.

- 20% increase in making informed financial decisions.

- 34% increase understanding banks ethical polices.

Key documents: News story – Executive Summary – Full report & Appendix – Press release.

Independent Evaluation - Preventing youth homelessness - The Money House Report 2017/18

Avoiding evictions and reducing debts.

Avoiding evictions and reducing debts.

The latest of our independent reports into the effectiveness of MyBnk’s financial education projects has shown dramatic reductions in the number of vulnerable young people being evicted from UK social housing.

Nearly a thousand 16-25 year olds, in care or sheltered accommodation, took part in a two year impact study of ‘The Money House‘ project in London.

Findings from independent evaluators, ERS, found participants were now three times less likely to have unsustainable arrears and there was a 64% drop in evictions for those ‘at risk’ of losing their home. The report was part funded by the Money Advice Service.

In the midst of a housing and homelessness crisis, research tells us one in three care leavers currently lose their first home and 83% of evictions are caused by rent arrears. Only 1% of The Money House graduates have ever been evicted.

Capability and exclusion

After MyBnk’s expert-led intervention there was a:

After MyBnk’s expert-led intervention there was a:

- 45% reduction in those incurring bank charges and missing bills.

- 22% increase in those borrowing safely, and therefore avoiding loan sharks.

- 27% increase in confidence managing money, which exceeds the national average.

There were also large reductions in instances of financial and digital exclusion for those who were unbanked and had never saved or budgeted. 54% were now saving, 35% budgeting, 75% now had a current account and 44% use online banking.

Every £1 spent on the programme generated £3.36 in social value, according to the respected Housing Association Charitable Trust social value model.

Key documents: News story – Executive Summary – Full report & Appendix – Cost Benefit Analysis – Press release.

Case Studies: Chanel, 19 – Hawa, 20 – Tameera, 20.

Money Advice Service 'What Works' - Young adults Impact Study 2017/18

Expert-led financial education “elevates playing field” for UK’s vulnerable young adults.

Our latest Money Advice Service funded report focuses on a yearlong impact study of our ‘survival’ money management programme, Money Works. Independent evaluators, ERS, examined its effectiveness with over a thousand 16-25 year old NEETS and care leavers, who are on average more likely to be in poverty and have problem debt.

Our latest Money Advice Service funded report focuses on a yearlong impact study of our ‘survival’ money management programme, Money Works. Independent evaluators, ERS, examined its effectiveness with over a thousand 16-25 year old NEETS and care leavers, who are on average more likely to be in poverty and have problem debt.

The report showed:

£1 spent on the programme created £5.57 in social value and the impact increased as time went on.

£1 spent on the programme created £5.57 in social value and the impact increased as time went on.

- Debts dropped 60%. This compared to control groups of their peers, who saw their average debts grow by 50%.

- The number saving regularly increased by 23%.

- Over half would now seek specialist advice, up from 32%, from the likes of StepChange or Citizens Advice.

- Capabilities of young people in saving, financial confidence, life satisfaction and digital literacy, which were below the national average, are now above it.

National Averages

MyBnk found vulnerable young people were below the national average for their peers across a range of indicators, but after intervention, exceeded their more capable peers in the long term:

The study showed:

- Life satisfaction increased by 28%.

- There was a 24% improvement in financial confidence.

- More now go online to make government transactions, such as paying tax, than the national average – boosting digital literacy.

Key documents: News story – Executive Summary – Full report & Appendix – Press release.

Case studies – Individual: Bexley Leaving Care – Crystal Palace FC.

Case studies – Institutions.

Money Advice Service 'What Works' - Primary Impact Report 2017/18

Deferring gratification and kickstarting saving habits.

Young people can defer gratification and start saving if exposed to expert-led financial education at primary school age, according to a ground-breaking study of MyBnk’s workshops in England.

Substance, an independent research group, found 7-11 year olds are also able to understand new knowledge such as banking, gain skills like budgeting, forge habits including resisting temptation and conceptualise the future by recognising the consequences of financial decisions.

The academic yearlong study analysed data from 1,444 pupils and 187 teachers at 86 schools participating in our Money Twist programmes as part of the Money Advice Service’s (MAS) ‘What Works’ project testing the effectiveness of interventions across the UK.

Source: MyBnk, Substance, Ipsos Mori. 2017/18.

Source: MyBnk, Substance, Ipsos Mori. 2017/18.

Dramatic improvements in financial capability were detected with pupils reporting low knowledge, confidence and regular saving patterns. Sessions including videos, manga comics, games and role play covered the value of money, consumer choices, mind-sets and prioritisation. Four hours of face-to-face expert led sessions were supported with six hours of teacher resources and four hours of family activities.

Key documents: News post – Full Report & Appendix – Executive Summary – Press release.

Money Advice Service & University of Bristol -

Evidence Hub.

The Money Advice Service’s ‘Evidence Hub’ has found MyBnk is delivering proven and evaluated financial education programmes for young people.

The Money Advice Service’s ‘Evidence Hub’ has found MyBnk is delivering proven and evaluated financial education programmes for young people.

Dozens of UK projects were scrutinised examining ‘what works’ in financial literacy in an effort to raise standards and outcomes.

According to the hub, our flagship schools programme, Money Twist, for 11-18 year olds resulted in financial capability improvements in:

- Mindset: Attitudes, values and self-belief in relation to money.

- Ability: Knowledge about money and the financial system and increased skills.

Qualitative follow-up research conducted eight months after the programme suggests key knowledge had been retained.

Project Oracle – Evidence Hub

MyBnk won a major award from Project Oracle for proving the positive impact of our financial education programmes on the lives of young people.

MyBnk won a major award from Project Oracle for proving the positive impact of our financial education programmes on the lives of young people.

The Mayor of London and Metropolitan University initiative is London’s first children and youth evidence hub. They examined our training and quality methods as well as independent assessments, concluding we are:

“…an exceptional youth sector organisation that demonstrates a direct benefit for young people’s employment and life chances”.

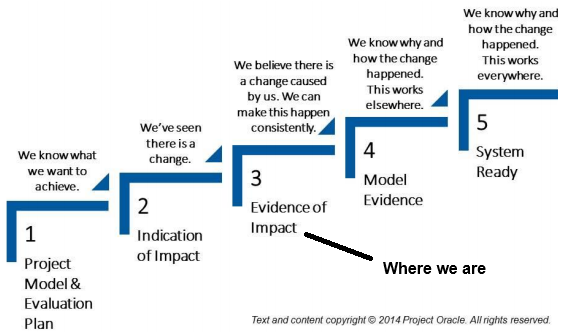

Simultaneously, MyBnk were certified as Standard 3, meaning we:

“Demonstrate through rigorous evaluation, that we are having a measurable effect on our most important outcomes: Financial Literacy”.

Standard 3 is:

Standard 3 is:

A project that has undertaken evaluation that draws a consistent link between the project and the change in outcomes, indicating that the project has caused the observed changes. The project also has procedures in place to increase the likelihood of it being implemented in the future in ways faithful to its design.

Impact Champions

MyBnk has been recognised for its leading role in impact measurement by being accepted into the ‘Impact Champions Network’ with the New Philanthropy Capital.

MyBnk has been recognised for its leading role in impact measurement by being accepted into the ‘Impact Champions Network’ with the New Philanthropy Capital.

Impact Champions work directly with voluntary organisations and support them to develop their impact practice, comprising a range of organisations from funders, commissioners, membership bodies and infrastructure organisations.

As an Impact Champion, MyBnk has committed to help increase the capacity for impact measurement across the sector by engaging with and increasing the use of impact practice resources, spreading awareness of the importance of impact measurement to our wider networks and establishing a best-practice code of conduct.

J.P. Morgan/Oxford ISIS Innovation Impact Report 2011

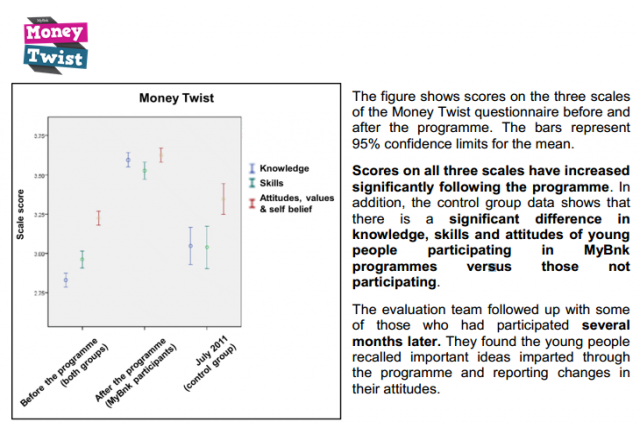

During the academic year 2010-11, four programmes were the focus of an impact evaluation by independent consultants: Money Twist, Money Works, Uni Dosh and MyBnk-in-a-Box.

295 MyBnk programmes were delivered to 6,286 young people in twenty secondary schools and youth organisations in Lambeth, London. This work was made possible with the support of the J.P. Morgan Chase Foundation.

Three areas of financial capability were measured; knowledge, skills and attitudes, values & self-belief. The key findings of the report include:

- Money Twist for 11-16 year olds, scores on all three areas increased significantly. In addition, the control group data shows there is a significant difference in knowledge, skills and attitudes of young people participating in MyBnk programmes versus those not participating.

- The evaluation team followed up with some of those who had participated in Money Twist several months later. They found the young people recalled important ideas imparted through the programme and reporting changes in their attitudes.

- Evaluators found strong evidence of the efficacy of Money Works programmes for vulnerable young adults.

- Feedback on the MyBnk trainers was extremely positive, with 98.5% saying their trainer was good or very good.

MyBnk J.P. Morgan Oxford ISIS Innovation Impact Report Summary.

MyBnk J.P. Morgan Oxford ISIS Innovation Impact Full Report.

Cabinet Office 2013

In the summer of 2013, MyBnk delivered dozens of financial education programmes to over two thousand 16-18 year olds taking part in the National Citizens Service in partnership with the Cabinet Office, Reed in Partnership and the Football League Trust.

In the summer of 2013, MyBnk delivered dozens of financial education programmes to over two thousand 16-18 year olds taking part in the National Citizens Service in partnership with the Cabinet Office, Reed in Partnership and the Football League Trust.

Here are the results of a sample of 441 participants in which 89% of young people said Money Twist workshops gave them good/excellent skills like budgeting and banking.