Our expert-led school age programmes aim to build financial capability at key transitional moments, addressing mindsets, attitudes and behaviours to help young people form an understanding of the wider world of money.

Our financial education workshops help form positive habits like saving and delayed gratification, connect the dots between public and personal finance and arm young people with practical money skills. This teaches them how to navigate the system and make informed decisions. Topics range from budgeting, banking and borrowing to student finance, tax and pensions.

Many of our programmes are free or funded and can be delivered either directly in-person, virtually via secure video link or as online courses.

See our Impact section and case studies for evidence on the powerful effect of our school programmes and how we map to the National Curriculum. We also provide a range of programmes for young adults outside of mainstream education and several home learning products.

Primary

Money Twist - Lower KS2

Aimed at 7-9 year olds in primary schools. This combines full year assemblies, workshops and teacher and family resources to build positive habits early, such as saving and budgeting and improving financial confidence. Online version also available. Independently Assessed by the Money Advice Service’s ‘What Works’ Fund.

Money Twist - Upper KS2

Aimed at 9-11 year olds in primary schools. This combines full year assemblies, workshops and teacher and family resources to build positive habits early, such as saving and budgeting and improving financial confidence. Online version also available. Independently Assessed by the Money Advice Service’s ‘What Works’ Fund.

Secondary

Money Twist KS3

Aimed at 11-14 year olds in secondary schools. This programme covers practical and relevant everyday financial matters including budgeting, needs vs wants, careers, tax, banking, interest, and savings. An online version is also available. Independently evaluated by the Money Advice Service’s ‘What Works Fund’.

Money Twist KS4

Aimed at 14-16 year olds in secondary schools. This programme covers practical and relevant everyday financial matters including budgeting, investments, needs vs wants, careers, tax, fraud, banking, and savings. Independently evaluated by the Money Advice Service’s ‘What Works Fund’.

Sixth Form / College

Money Twist KS5

Aimed at 16-18 year olds in secondary schools. This programme covers practical and relevant everyday financial matters including minimum wage, payslips, national insurance, tax, pensions, living costs, needs and wants, budgeting, credit and debt and savings.

Sporty Money Twist

Bringing money to life through sport. This innovative blend of active games and discussions communicates key financial messages like budgeting, tax and consumer choice in a physical, fun and effective way. Developed for outdoor provision such as National Citizenship Service.

Money Mechanics

A ground-breaking financial and enterprise education programme aimed at boosting the financial literacy and confidence of young Deaf and blind people in the UK.Online tools here. Delivered by the Royal Association for Deaf people. Training in Sight Impaired financial education available by MyBnk.

Uni Money Tips

Planning For Uni Can Be Overwhelming – especially the money side of things. But, it doesn’t have to be. We’ve created a guide to give you the information you need to become financially independent covering student finance, banking, borrowing, budgeting and spending. An in-person version is also available.

Money Works

This accredited survival money management programme focuses on independent living, digital finance skills and debt prioritisation. A virtual version is also available. Independently evaluated by the Money Advice Service’s ‘What Works Fund’.

Consultation & Collaboration

We want to reach more young people by supporting other organisations and sharing our expertise in financial education and enterprise.

Free Resources

Bring money to life with these select choices from our award winning workshops covering topics such as saving and budgeting, jargon busting and enterprise and videos.

View moreHow does it work?

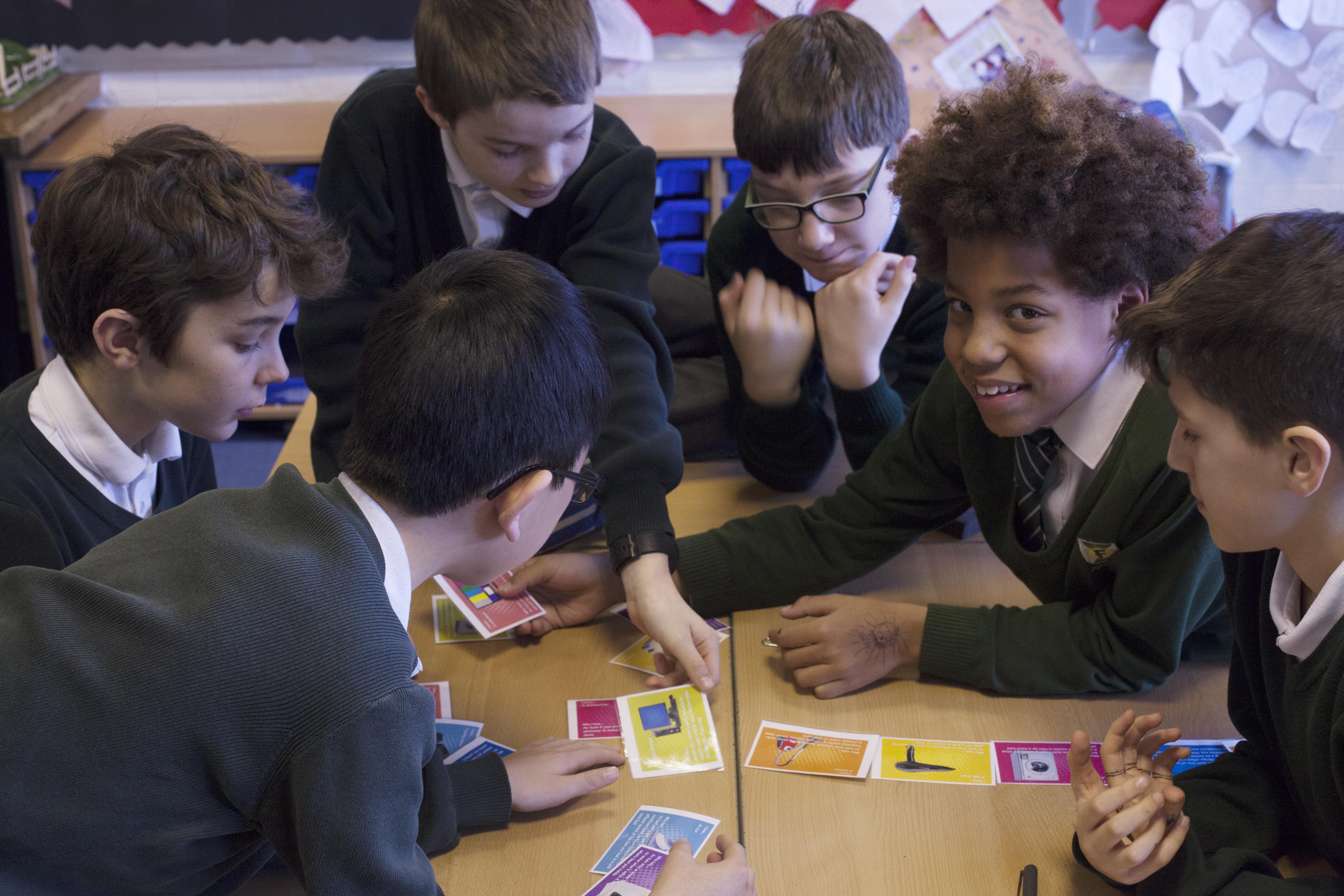

MyBnk’s expert trainers will come to your organisation with our colourful resources including worksheets, powerpoints and audio-visual aids to deliver our workshops.

Sessions range from single 100 minute blocks to full days and programmes spread out over several weeks. Programmes are closely mapped to the National Curriculum, been independently assessed and have won a number of high profile awards and press coverage.

Impact After Our Programmes

73

Teachers that believe

MyBnk training is more effective

than traditional methods

70

Children who stick to their money

saving plans a year later

60

The average debt reduction of young adults in our workshops

Education & Facilitation Team

"The more you LEARN the more you EARN".

"An investment in knowledge pays the best interest." - Benjamin Franklin

"Better spend an extra hundred or two on your son's education, than leave it him in your will." ~ The Mill on the Floss by George Eliot