Handy tips, websites and apps to help you budget your money, keep tabs on spending and get good

Whether you’ve completed our course or not…

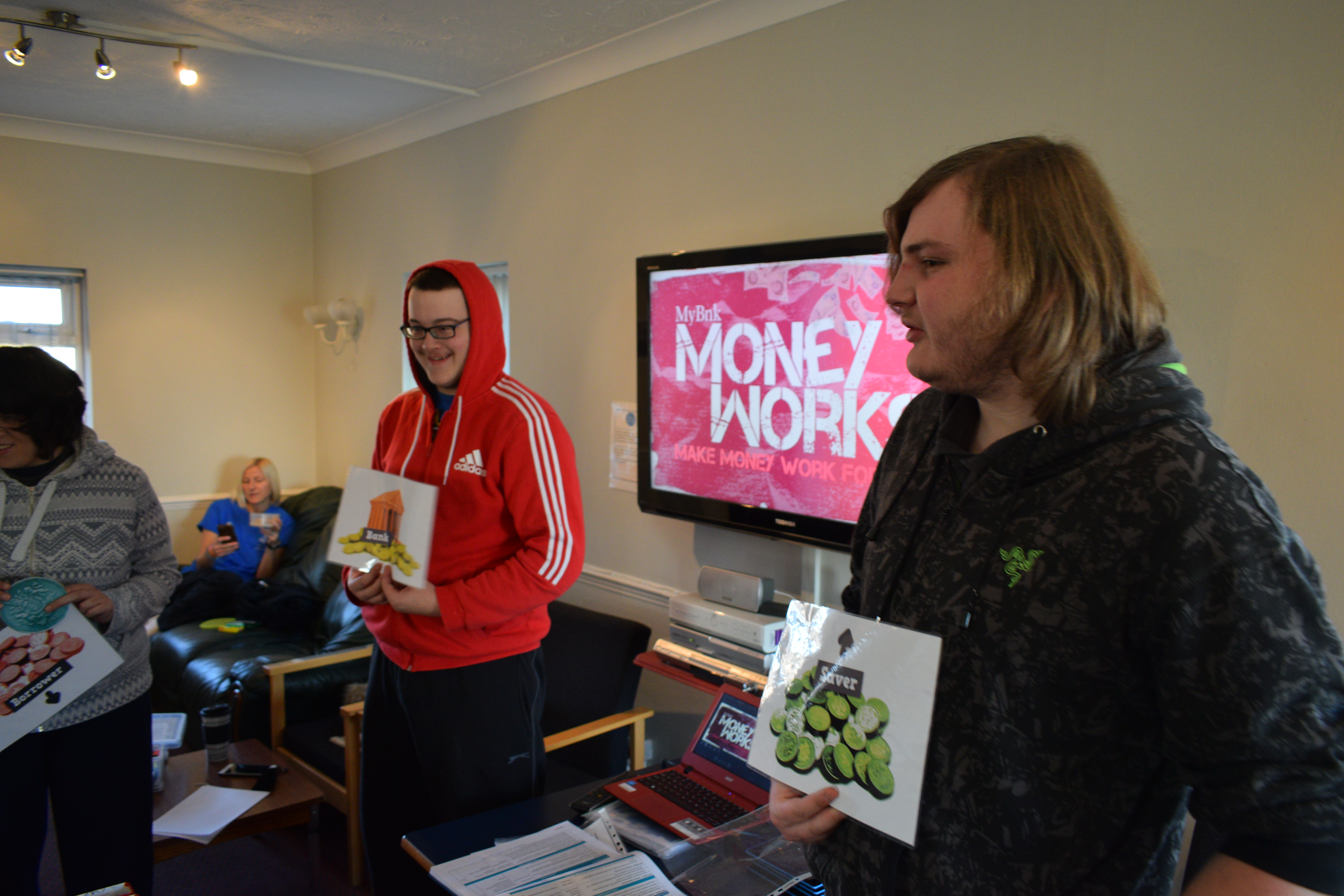

We’re here to make money work for YOU. Click the Next Steps below and start to take control of your finances so they don’t control you.

1: Budgeting & Household Costs

Information, websites and apps to help you budget, keep tabs on your spending and stay on top of your household costs.

2: Your Income

The latest minimum wage and tax figures, benefits information and more websites and apps to help you keep on top of your income.

3: Banking & Beyond

Confusing banking jargon, interest rates and the best types of bank account for you. Complete with useful websites and apps to help you manage your money.

4: Borrowing & Scams

How to borrow responsibly, keep on top of your credit score and avoid scams. Plus what to do if you get into debt.

Impact After Our Programmes

73

Teachers that believe

MyBnk training is more effective

than traditional methods

70

Children who stick to their money

saving plans a year later

60

The average debt reduction of young adults in our workshops