Policy and Influence

MyBnk is deeply involved in wider efforts to address social economic issues effecting young people - be it financial exclusion, youth unemployment or the care system.

MyBnk shares our frontline impact data and expertise through:

- All Party Parliamentary Groups (APPG) and campaign groups.

- Evidence submissions, responding to reports, contributing to studies and consultations.

- Independent impact assessments of MyBnk programmes.

- Membership of the Youth Financial Capability Group, a representative body of financial education providers.

- Meeting regularly with the Money Advice Service, including serving on committees related to the UK Financial Capability Strategy.

- Membership of the Consumer Advisory Board of UK Finance, held by CEO Guy Rigden.

Our influence

Inquiry into corporate parenting in Scotland – October 2023

MyBnk’s opinion on corporate parenting in Scotland in response to the Independent Review of Children’s social care.

MyBnk and Compare the Market launch research on the current state of financial education in UK secondary schools – May 2023

Only 2/5 young adults are financially literate finds research by MyBnk and Compare the Market. Full report available here.

Response to the APPG for financial education report – March 2023

Outgoing CEO Guy Rigden reflects on a new report from the All Party Parliamentary Group for Financial Education.

Services for care experienced children: exploring radical reform – written consultation – February 2023

MyBnk’s opinion on the support available for young people when they leave care. In response to a consultation from the Welsh government.

Care Leavers Report – October 2022

MyBnk published a report on the financial support provided to care leavers by local authorities and whether it is sufficient for them to transition into independent living.

Dormant Assets consultation – October 2022

The Youth Financial Capability Group (YFCG) wrote an open letter to the government on utilising the dormant assets for funding financial education of young people. MyBnk also responded to the dormant assets consultation.

Our submission includes the results of independent assessments into our flagship primary school programmes, Money Twist KS2 Lower and Upper plus virtual and home learning courses.

MyBnk has responded to the UK’s Financial Conduct Authority Call for Input considering systemic issues that need to be fixed in the consumer investment market.

Our contribution relates to the positive and proven impactful role of financial education in helping young people make informed decisions and boost financial literacy.

Data analysis of MyBnk programme shows young UK females lack financial confidence and suffer poor mental health due to money troubles.

Our teams have crunched the data on 3,700 11-25 year olds taking part in our money programmes, in-and-out of schools, over a year.

MyBnk found nearly half of girls (43%) were not financially confident, 18% less so than boys. And 10% more of young women suffered anxiety and depression about money than their male counterparts. Full story here.

APPG Financial Education for Children in Care Report 09/07/19

A report has been published on the quality and reach of financial education for young people in and leaving the UK care system. It makes a range of recommendations including better money lessons in mainstream and non-mainstream schools, more funding for local authorities and a ‘one-stop-shop’ for the financial education of care leavers. It recommends financial services support the work of organisations like MyBnk.

Our submission includes the results of independent assessments into our two flagship Young Adult programmes The Money House and Money Works. You can read our submission, here.

Money & Pensions Service (MaPS): Listening Document – 25/06/19

MyBnk has responded to MaPS Listening Document which outlines what the new national financial capability body sees at its role, needs assessments and priorities. See an executive summary of that document here and our response here.

London Children in Care & Partnership for Young London – Social Action Research Report – 30/05/19

A report written by care leavers cites money management as a priority for provision and support. Our youth homelessness prevention scheme, The Money House, features prominently.

A key recommendation: “All boroughs to provide MyBnk or similar money management course designed around the needs of care experienced young people to prepare for independent living”. See the full report here.

Ofsted Inspection Framework Consultation – 14/05/19

MyBnk has submitted evidence on changes to the inspection criteria for schools in England. This includes reference to the role financial capability plays in the overall quality of education and recommendation that it be brought more explicitly into the inspection framework.

Department for Education Consultation: Changes to the teaching of Sex & Relationship Education and PSHE 13/02/18

MyBnk has responded to a consultation examining what and how schools teach topics within PSHE in England.

See our submission, here, and further evidence, here.

London Assembly – Economy Committee – Short changed 08/01/18

An investigation into the financial health of Londoners has made a number of recommendations to the Mayor of London’s office. It called for more work with schools, charities and the financial services industry to deliver high quality financial education for young people. MyBnk gave both written and oral evidence to the consultation regarding youth financial capability.

See MyBnk’s response, here.

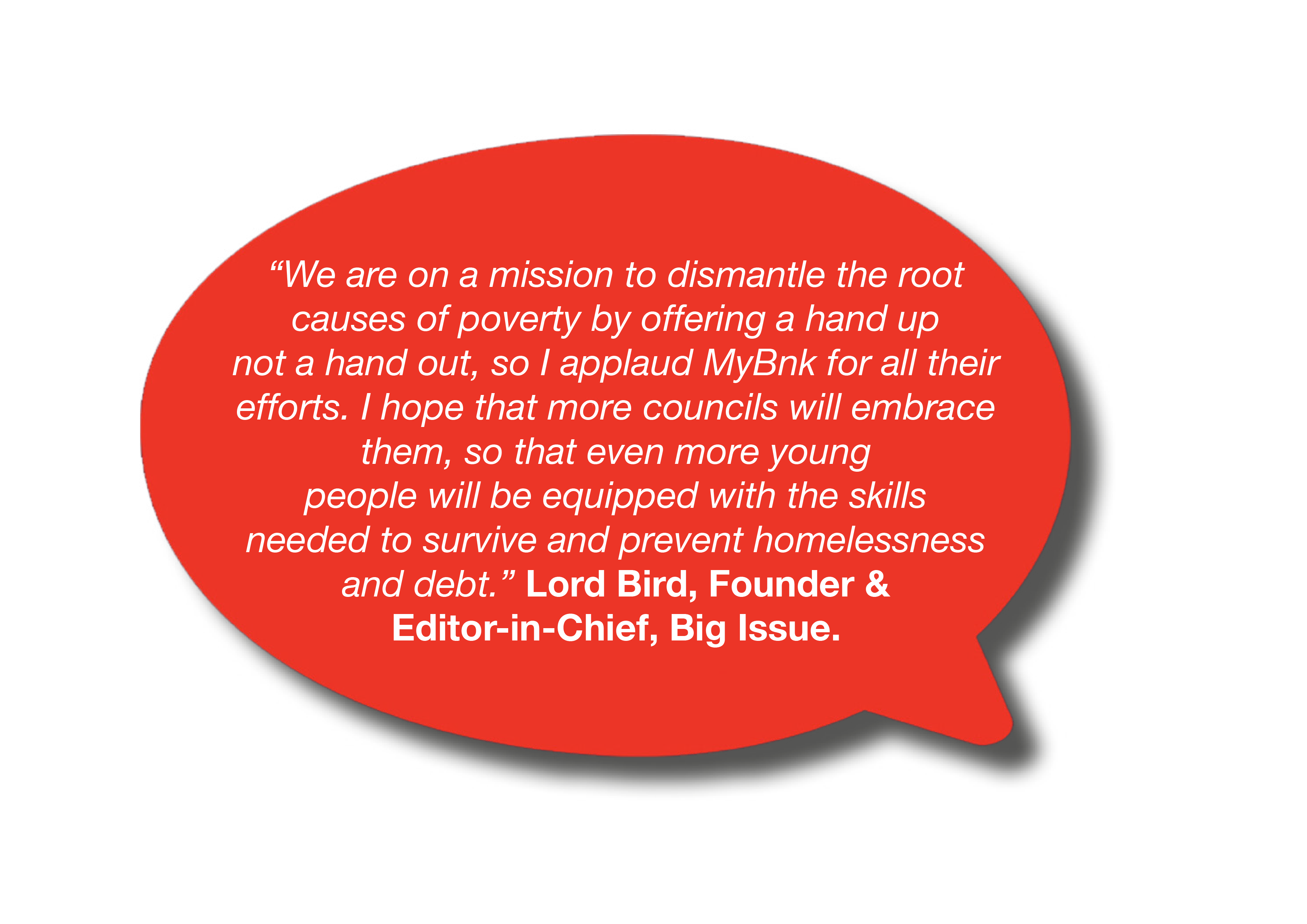

APPG for Ending Homelessness – Homelessness Prevention Report 18/07/17

MyBnk’s youth homelessness prevention project, The Money House, featured as a case study in this leading report. There was a clear recommendation that council’s ensure young care leavers have access to effective financial education.

House of Lords – Financial Exclusion Committee 23/05/17

MyBnk has given written and oral evidence to a study into the causes and solutions to financial exclusion in the UK. The report’s recommendations include making financial education compulsory for primary school pupils and that the Ofsted Common Inspection Framework should include how schools address financial literacy.

Please click here to view our policy work before 2017.

Communications Team

“Beware of little expenses. A small leak will sink a great ship.” – Benjamin Franklin